原文:https://blog.euler.finance/eulers-approach-to-distrupting-the-incumbents-32ea6342b0c4

Euler is the most innovative lending and borrowing protocol in the DeFi space when it comes to features, security, and scalability, and is now set to grow at a rapid pace.

Euler在功能、安全性和可扩展性方面, 是 DeFi 领域最具创新性的借贷协议,并将快速增长。

Euler has been locked in development with numerous safe mode measures in place, but it is now ready to disrupt the industry by leaps and bounds. Euler’s unique set of features present the ideal platform for native DeFi users and new users looking to engage with the future of finance.

Euler 已通过多种安全模式措施确保发展(潜力),不过现在它已准备好跨越式颠覆行业。 Euler独特功能集为原生DeFi 用户和希望参与未来金融的新用户提供了理想的平台。

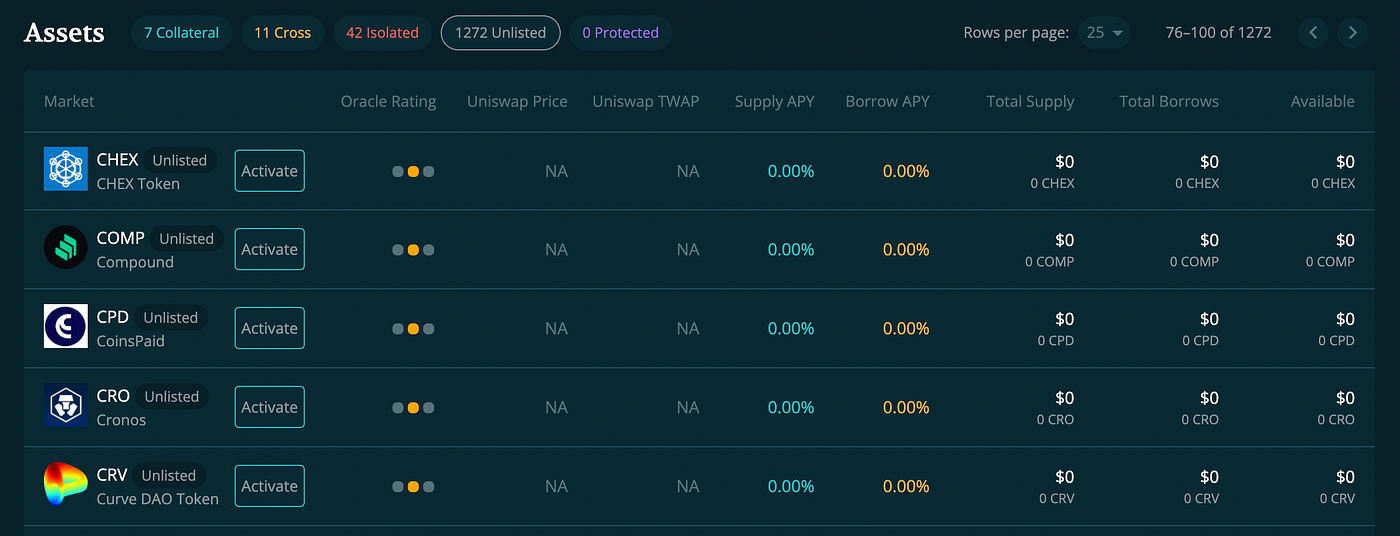

去审批化/无许可上币 (Permissionless Listing)

As a custom-built system to support long-tail assets from the start, Euler is able to manage the risks involved with opening up listings to the public. Euler full-heartedly supports decentralisation by offering a platform to ensure that the market decides which assets should be borrowed or lent. There are already 60 markets activated on Euler.

作为从一开始就支持长尾资产的可定制系统,Euler能够管理向公众开放 上币 所涉及的风险。Euler通过提供让市场决定应该借入或借出哪些资产的一个平台,全心全意地支持去中心化。Euler 上已经激活了 60 个市场。

(只需单击按钮即可激活任何市场 Simply activate any market with the click of a button)

借入因子 (Borrow Factors)

Lending and borrowing protocols need to manage the risks of volatile or illiquid assets, and therefore it is essential to adjust loan-to-value ratios so that overcollateralisation can prevent bad debts. Borrow factors can also be adjusted via governance to best reflect the asset’s underlying risk.

借贷协议需要管理波动性或非流动性资产的风险,因此必须调整贷款对价值的比率,以便超额抵押来防止坏账。 借入因子 也可以通过治理进行调整,以最好地反映资产的潜在风险。

去中心化价格预言机 (Decentralised Price Oracles)

The Euler team has put enormous effort behind researching oracles and developing tools to illuminate risks. Research by Euler’s CEO Michael Bentley highlights the difficulty in carrying out attacks on decentralised oracles such as Uniswap v3’s Time Weighted Average Price (TWAP). Euler’s Oracle tool can also show the oracle risks involved with different Uniswap V3 pools.

Euler 团队在研究预言机和开发 工具 来阐明风险方面,付出了巨大的努力。Euler首席执行官 Michael Bentley 的 研究 强调了对去中心化预言机进行攻击的难度,比如 Uniswap v3 的时间加权平均价格 (TWAP)。 Euler 的 预言机工具 还可以显示不同 Uniswap V3 矿池所涉及的预言机风险。

荷兰式拍卖清算 (Dutch-Auction Liquidations)

Not only does Euler limit MEV, but large borrowers will find the liquidation process less taxing compared to other protocols. Expected borrowing costs are drastically lower as Euler gives the market a voice in how much of a bonus that liquidators can receive. According to the Euler Dune dashboard from Shippooordao, the average liquidation bonus has been around 2.13%.

Euler 不仅限制 MEV,且与其它协议相比,大型借款人会发现 清算过程 的征税更少。预期的借贷成本大大降低,因为Euler使得市场对清算人可以获得多少奖金有了发言权。根据 Shippooordao 的 Euler Dune 仪表盘,平均清算奖金约为 2.13%。

交易建设者 (Transaction Builder)

Users can batch build their transactions into a convenient list before a final submission. This reduces gas costs and helps to manage complex positions while previewing estimated costs and potential conflicts with the transactions.

用户可以在最终提交之前将他们的交易批量构建到一个方便的 列表 中。这降低了 gas 成本并有助于管理复杂的头寸,同时可以预估预览成本与潜在的交易冲突。

模块化智能合约设计 (Modular Smart Contract Design)

Euler’s smart contracts allow the community to upgrade oracles and other features without having to force users to migrate liquidity to a new protocol for each change. This design is much more optimal for decentralisation and DAOs. Scalability through redeployment is not scalability.

Euler 的 智能合约 允许社区升级预言机和其他功能,而用户每次更改后无需强制将流动性迁移到新协议。这种设计对于去中心化和 DAO 来说更加优化。重新部署得来的可扩展性不是(真正的)可扩展性。

受保护抵押物 (Protected Collateral)

By protecting collateral from borrowers, users can prevent governance manipulation and short selling, and it is free from the risks of borrowers defaulting. This also helps reduce risks for DeFi native hedge funds and large borrowers.

通过借款人的受保护抵押物,用户可以防止被治理操纵和卖空,也没有借款人违约的风险。这也有助于降低 DeFi 原生对冲基金和大型借款人的风险。

隔离和交叉/跨层借贷模式 (Isolated and Cross Borrowing Modes)

Euler’s innovative approach helps to mitigate the systemic risks posed by long-tail assets while ensuring these riskier assets have a place in the lending and borrowing market. Isolated and cross tier assets can be borrowed and lent but not used as collateral. Cross tier assets can also be borrowed alongside other assets. This prevents bad debt situations from risky collateral assets.

Euler 的创新方法有助于减轻长尾资产带来的系统性风险,同时确保这些风险较高的资产在借贷市场中依然占有一席之地。 隔离 和跨层资产可以借入和借出,但不能用作抵押品。跨层资产也可以与其他资产一起借入。这可以防止因抵押高风险资产而产生的坏账情况。

高效杠杆 (Efficient Leverage)

Leverage can be built up quickly and extremely cheaply using the Mint and Burn functions. Users no longer need to develop complex recursive strategies or move to third-party solutions. Euler’s development in this area enables higher collateral ratios for highly correlated assets.

可以使用 Mint 和 Burn 功能快速且极其便宜地创建杠杆 。用户不再需要开发复杂的递归策略或转向第三方解决方案。Euler在这一领域的发展,为高度相关的资产提供了更高的抵押比率。

子账户 (Sub-accounts)

Euler’s sub-accounts makes trading even easier for users by eliminating the need to use multiple wallets to create multiple position. Users can manage positions and save on gas with minimal approvals in just one wallet.

Euler 的 子账户 消除了使用多个钱包创建多个头寸的必要,使得用户的交易更加轻松。用户只需在一个钱包中获得最少的批准即可管理头寸并节省gas。

无费用和广义闪电贷 (Feeless and Generalised Flash Loans)

Researchers and advanced traders will find flash loans on Euler more economical as there is no interest or fees for this service. Use a liquidity deferral to flash loan multiple assets at once or perform complex position management.

研究人员和高级交易员会发现 Euler 上的 闪电贷 更经济,因为不收取利息或费用。使用流动性展期一次闪贷多种资产或执行复杂的头寸管理。

回应性利率 (Reactive Interest Rates)

As an Euler innovation that maximises capital efficiency on the protocol, utilisation is balanced at 70% by automatically adjusting the interest rates without the need for governance.

作为Euler协议上最大化资本效率的创新,通过自动调整 利率,利用率平衡在 70%而无需治理介入。

多/空功能 (Short/Long Function)

Users can conveniently create leveraged positions using the mint and burn functions in combination with Euler’s 1inch and Uniswap integrations that allow users to take out gas-efficient long and short positions in a single click.

用户可以使用铸币和燃烧功能方便地创建杠杆 仓位 ,结合 Euler 的 1inch 和 Uniswap 集成,让用户可以高效一键生成做空做多头寸。

量表 (Gauges)

Liquidity mining on an asset could be automatically enabled by locking a certain amount of EUL tokens. The emission would increase by locking/voting for that asset. This feature can empower communities to vote for their preferred assets and gain more voting rights in the protocol.

通过锁定一定数量的 EUL 代币,可以自动启用资产的流动性挖掘。通过锁定/投票该资产,产出量可以增加。这个功能 可以让社区为他们喜欢的资产投票,并在协议中获得更多的投票权。

民主化流动性挖矿 (Democratised Liquidity Mining)

Native mining functionality enables EUL tokens to get mined by anyone at low costs. Any user can take part in the future of Euler due to the low learning curve and barrier to entry.

原生挖矿功能使 任何人 都能够以低成本挖掘 EUL 代币。因为学习曲线低且进入门槛低,任何用户都可以参与 Euler 的未来。

预计清算时间 (Estimated Time to Liquidation)

This feature focuses on the estimated time in days until a liquidation will occur, assuming the asset prices and interest rates will not change. When crafting a position, users can understand the risk of liquidation due to the borrowing interest rate and better manage their leverage.

此功能 的重心是:假定资产价格和利息不变的情况下,发生清算的预计天数。在构建头寸时,用户可以了解由于借款利率而导致的清算风险,并更好地管理自己的杠杆。

While these are just some of Euler’s many unique features, even more can be found in the white paper. Please check out the Discord community and governance forums for even more info on how Euler is revolutionising lending and borrowing in DeFi.

虽然这些只是 Euler 的众多独特功能中的一部分,但在白皮书 中可以找到更多功能。请查看 Discord 社区和治理 论坛 了解有关 Euler 如何彻底改变 DeFi 借贷的更多信息.

关于Euler (About Euler)

Euler is a capital-efficient permissionless lending protocol that helps users to earn interest on their crypto assets or hedge against volatile markets without the need for a trusted third-party. Euler features a number of innovations not seen before in DeFi, including permissionless lending markets, reactive interest rates, protected collateral, MEV-resistant liquidations, multi-collateral stability pools, sub-accounts, risk-adjusted loans and much more. For more information, visit euler.finance.

Euler 是一种资本效率高的无许可借贷协议,可帮助用户从其加密资产中赚取利息或对冲波动的市场,而无需受信第三方。 Euler 具有许多在 DeFi 中前所未有的创新,包括无许可的借贷市场、回应性利率、受保护的抵押品、抗 MEV 清算、多抵押品稳定池、子账户、风险调整贷款等等。有关更多信息,请访问 euler.finance。

加入社区 (Join the Community)

Follow us Twitter. Join our Discord. Keep in touch on Telegram (community, announcements). Check out our website. Connect with us on LinkedIn.

关注我们 Twitter。加入我们的 Discord。在 Telegram 上保持联系(community、announcements)。查看我们的网站。在 LinkedIn 上与我们联系。