原文:https://messari.io/article/euler-finance

原文作者: Seth Bloomberg

Lending and borrowing protocols form one of the cornerstones of the crypto financial markets. As DeFi has matured, these protocols are typically found at the bottom layer of the “money lego” stack, creating a foundation for building more complex financial instruments. In their simplest form, these protocols serve as a mechanism for retail investors to deposit funds and earn yield on them. Two of the largest lending and borrowing protocols on Ethereum, Compound and Aave, boast a combined ~$21 billion in deposits and have a 35% and 30% utilization rate, respectively. Other protocols tap into these platforms too, with the yield aggregator Yearn Finance, for example, holding ~27% of Compound’s cDai as of this writing.

借贷协议构成了加密金融市场的基石之一。随着 DeFi 的成熟,这些协议通常位于“货币乐高”堆栈的底层,为构建更复杂的金融工具奠定了基础。这些协议最简单的形式是散户投资者存入资金并从中赚取收益的一种机制。以太坊上两个最大的借贷协议 Compound 和 Aave,总存款约为 210 亿美元,使用率分别为 35% 和 30%。其他协议也利用这些平台,例如收益聚合器 Yearn Finance,在撰写本文时占有 Compound 的 cDai 的 约27%。

Since these protocols serve as a foundational layer to the wider ecosystem, it should come as no surprise that these platforms are primarily concerned with risk management. To illustrate this fact, Compound and Aave have partnered with Gauntlet to ensure the risk parameters across their various markets are properly managed. Gauntlet simulates and models a variety of scenarios within DeFi and then proposes updates to parameters (such as an asset’s collateral factor) based on their analysis. The goal is to strike a balance between creating a capital-efficient protocol and mitigating any potential losses for depositors.

由于这些协议是更广泛生态系统的基础层,这些平台主要关注风险管理也就不足为奇了。为了说明这一事实,Compound 和 Aave 与 Gauntlet 合作,以确保其各个市场的风险参数得到妥善管理。 Gauntlet 在 DeFi 中模拟和建模各种场景,然后根据分析提出对参数(例如资产的抵押因子)的更新。目标是在达到协议的资本效率和减轻储户的任何潜在损失之间取得平衡。

Governance plays an important role in these protocols, as risk parameter updates and new asset listings must go through their respective governance process. While this methodology helps ensure the protocol is protected from potential bad debt, it also creates a permissioned process for listing new assets. Long-tail assets effectively have no place in these protocols as they’d be deemed too risky to include in the shared collateral pool.

治理在这些协议中起着重要作用,因为风险参数更新和新资产上市必须经过各自的治理过程。虽然这种方法有助于确保协议免受潜在坏账的影响,但它也为列出新资产创建了一个许可流程。长尾资产实际上在这些协议中没有位置,因为它们被认为风险太大而不能包含在共享抵押品池中。

Rari Capital implemented Fuse pools to cater to these long-tail assets. Fuse pools can be thought of as isolated instances of Compound markets, allowing anyone to spin up and parametrize their own lending and borrowing markets. These Fuse pools have largely been a success, attracting over $900 million in supplied assets, as they’ve allowed larger token holders and DAOs to create markets for their governance tokens.

Rari资本 实施了熔断池来满足这些长尾资产的需求。熔断池可以被认为是复合市场的孤立实例,允许任何人启动和设置他们自己借贷市场的参数。这些熔断池在很大程度上取得了成功,吸引了超过 9 亿美元的供应资产,因为它们允许更大的代币持有者和 DAO 为其治理代币创建市场。

Although isolated markets like Fuse pools create a buffer between individual lending and borrowing markets and the wider protocol, there is still risk within each market. In January 2022, participants in Rari’s Fuse pool 90 experienced this risk firsthand. The pool uses the FLOAT/USDC Uniswap V3 oracle to retrieve price data for the FLOAT token. An exploiter was able to move the FLOAT price outside of the narrow liquidity band on Uniswap, severely inflating the value of the FLOAT token. With the highly inflated FLOAT value, the exploiter used FLOAT as collateral and was able to drain the majority of the pool's tokens.

尽管像熔断池这样的孤立市场在单个借贷市场和更广泛的协议之间建立了缓冲,但每个市场内部仍然存在风险。 2022 年 1 月,Rari第 90池 的参与者亲身体验了这种风险。该池使用 FLOAT/USDC Uniswap V3 预言机来检索 FLOAT 代币的价格数据。剥削者能够将 FLOAT 价格移动到 Uniswap 上狭窄的流动性范围之外,从而严重夸大了 FLOAT 代币的价值。由于 FLOAT 值高度膨胀,剥削者使用 FLOAT 作为抵押品,并且能够耗尽池中的大部分代币。

The designs of the aforementioned lending and borrowing platforms demonstrate the trade-offs when creating these markets. Compound and Aave can achieve a higher capital efficiency due to their underlying shared capital pool structure, and to counteract the risks associated with this approach, they must be diligent with their asset listings, relying on governance processes to achieve this. Rari and their Fuse pools isolate risks to individual markets, trading a loss in capital efficiency for a reduction in systemic risks. The FLOAT example, however, serves to reinforce the risks associated with unconstrained collateral usage.

上述借贷平台的设计展示了创建这些市场时的权衡取舍。 Compound 和 Aave 由于其潜在的共享资本池结构可以实现更高的资本效率,为了抵消与这种方法相关的风险,它们必须勤奋地进行资产上市,依靠治理流程来实现这一目标。 Rari 和他们的熔断池隔离了各个市场的风险,用资本效率的损失换取系统性风险的降低。然而,FLOAT 的例子强化了与使用不受约束的抵押品相关的风险。

The central problem for a lending and borrowing protocol is to effectively design mechanisms to maximize capital efficiency and provide markets for long-tail assets, all while protecting itself and its users from potential bad debt.

借贷协议的核心问题是有效地机制设计,来最大限度地提高资本效率并为长尾资产提供市场,同时保护自身及其用户免受潜在坏账的影响。

Euler金融 (Euler Finance)

Euler Finance leverages Uniswap V3’s time-weighted average price (TWAPs) coupled with a unique risk management framework in hopes of tackling the challenges described above. It is currently backed by Paradigm, Lemniscap, and angel investors such as Anthony Sassano, Kain Warwick, and Hasu. The Euler lending and borrowing protocol recently deployed in December 2021 to the Ethereum mainnet and has attracted ~$85 million in deposits, with USDC accounting for ~75% of total deposits.

Euler Finance 利用 Uniswap V3 的时间加权平均价格 (TWAPs) 以及独特的风险管理框架来应对所描述的多个挑战。它目前得到 Paradigm、Lemniscap 和天使投资人(如 Anthony Sassano、Kain Warwick 和 Hasu)的支持。 Euler 借贷协议 最近部署 于 2021 年 12 月进入以太坊主网,并吸引了约 8500 万美元的存款,USDC 会计占总存款的 75%。

无许可资产列表和风险管理 (Permissionless Asset Listings and Risk Management)

Lending and borrowing protocols use different approaches to manage assets. Compound and Aave rely on governance to determine which new assets can be added to their protocols, while protocols such as Rari allow the creator of the market to determine the allowed collateral. Euler allows anyone to create a lending market for an asset as long as it has a WETH pair on Uniswap V3, due to the fact that Euler leverages Uniswap’s TWAPs for asset pricing. Utilizing TWAPs for asset pricing implies that Euler markets will be less responsive to and impacted by volatile price movements in the wider market. While this does mean TWAPs are a lagging indicator and can thus be out of sync with certain spot market prices, it also means it will be much more difficult and expensive to manipulate prices.

借贷协议使用不同的方法来管理资产。 Compound 和 Aave 依靠治理来确定可以将哪些新资产添加到他们的协议中,而 Rari 等协议允许市场的创建者确定允许的抵押品。 Euler 允许任何人为资产创建借贷市场,只要它在 Uniswap V3 上有 WETH 对,因为 Euler 利用 Uniswap 的 TWAP 进行资产定价。利用 TWAP 进行资产定价意味着Euler市场对更广泛市场中价格波动的反应和影响将减弱。虽然这确实意味着 TWAP 是一个滞后指标,因此可能与某些现货市场价格不同步,但这也意味着操纵价格将更加困难和昂贵。

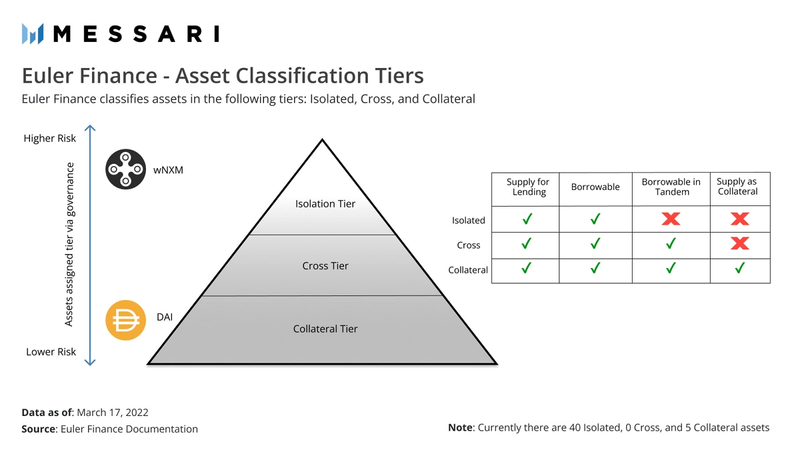

Allowing anyone to create a lending market around an asset benefits holders of long-tail assets, but it also introduces protocol-wide risks if that asset is exploited, as Euler has implemented a shared capital pool framework similar to Compound. To combat these risks, Euler has designed a tiered risk management framework which assigns each asset to a particular tier.

允许任何人围绕资产创建借贷市场有利于长尾资产的持有者,但如果该资产被利用,它也会引入协议范围的风险,因为 Euler 已经实施了类似于 Compound 的共享资本池框架。为了应对这些风险,Euler设计了一个分层的风险管理框架,将每个资产分配到一个特定的层级。

The majority of assets currently fall into the isolated tier. If a user borrows one of these assets against a certain collateral, then that’s the only asset which they can borrow against that collateral. Currently no assets are listed as cross tier; nonetheless, these assets cannot be used as collateral (this also applies to isolation-tiered assets), but they can be borrowed in tandem with other assets. Collateral-tiered assets garner the most functionality, and they can of course be used as collateral and also borrowed alongside other assets. Assets can be moved from tier to tier via governance proposals.

目前大部分资产都属于隔离层。如果用户以某种抵押品借入这些资产中的一种,那么这是他们可以针对该抵押品借入的唯一资产。目前没有资产被列为跨层(交叉层);但是,这些资产不能用作抵押品(这也适用于隔离层资产),但可以与其他资产一起借入。抵押资产具有最多的功能,它们当然可以用作抵押品,也可以与其他资产一起借入。资产可以通过治理提案从一层移动到另一层。

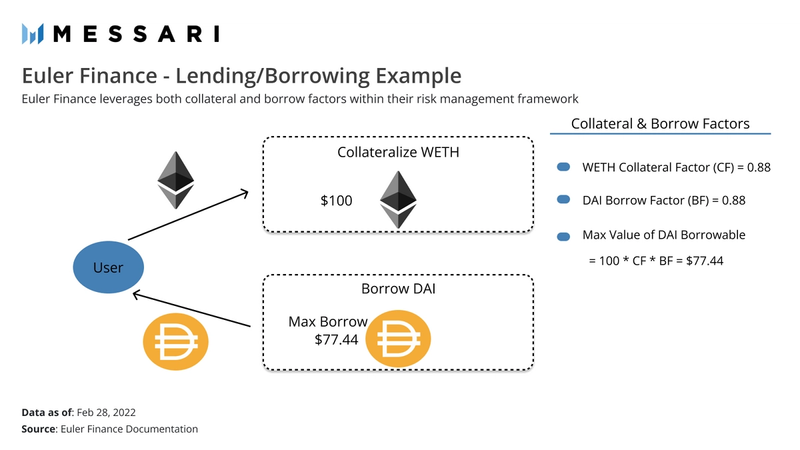

To further manage the risks within the platform, Euler implements both collateral and borrow factors. Compound, for example, associates a collateral factor with each asset, and this determines the maximum value which can be borrowed against that asset. This collateral factor is independent of the asset being borrowed, ignoring any risks associated with the borrowed asset. With both collateral and borrow factors, Euler is able to account upfront for price action in either direction for borrowed assets.

为了进一步管理平台内的风险,Euler 实施了抵押和借入因子。例如,Compound 将抵押因子与每项资产相关联,这决定了可以针对该资产借入的最大值。该抵押因子独立于所借资产,忽略了与所借资产相关的任何风险。借助抵押和借入因子,Euler能够预先考虑借入资产的任一方向的价格行为。

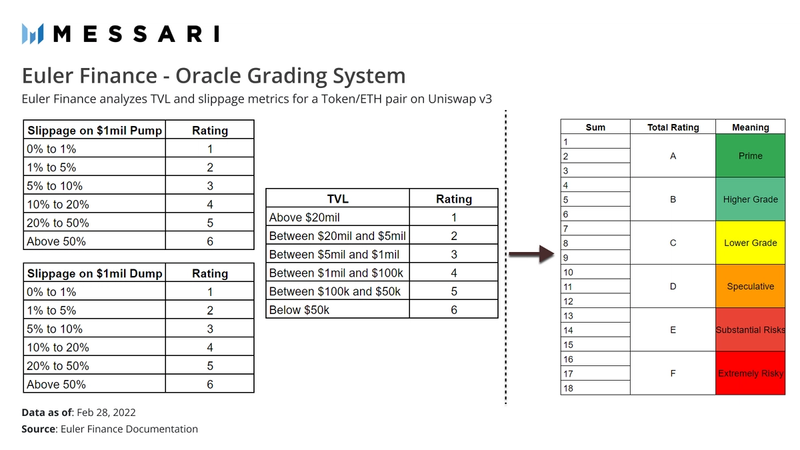

The FLOAT exploit example not only highlights the risk around collateral allowances, but also shows the risk associated with price oracles. Euler leverages Uniswap V3 TWAPs as an oracle for asset pricing. Currently, for each market setup on Euler, an associated “Oracle Rating'' will be calculated and displayed. The framework focuses primarily on the depth and concentration of liquidity for the asset/WETH pair on Uniswap V3.

FLOAT漏洞利用的示例,不仅突出了抵押品津贴的风险,还显示了与价格预言相关的风险。 Euler 利用 Uniswap V3 TWAP 作为资产定价的预言机。目前,对于 Euler 上的每个市场设置,将计算并显示相关的“预言机评级”。该框架主要关注 Uniswap V3 上资产/WETH 对的流动性深度和集中度。

This methodology will eventually be replaced with a more robust solution. Euler has already developed an oracle tool, which is also open sourced. At its core, the oracle tool simulates how costly it is to manipulate a given token/WETH pair on Uniswap V3. It allows for simulating a variety of scenarios by tweaking parameters such as the TWAP time internal (e.g., 30 minutes) and the target price of the token. Overall, this will provide a much more precise and robust methodology of computing an oracle’s grade.

这种方法最终将被更稳定的解决方案 取代。 Euler 已经开发了一个 预言机工具,它也是开源的。预言机工具的核心是模拟在 Uniswap V3 上操纵给定代币/WETH 交易对的成本。它允许通过调整参数来模拟各种场景,例如 TWAP 内部时间(例如,30 分钟)和代币的目标价格。总体而言,这将提供一种更加精确和强大的计算预言机等级的方法。

清算机制 (Liquidation Mechanics)

Depending on who is asked, the sentiment around liquidations will likely vary. For traders and borrowers, liquidations can be detrimental to their portfolio and a source of ultimate pain. But liquidations also play an integral role in keeping lending and borrowing markets healthy. If incentives for liquidations are not properly structured, then the worst-case scenario may lead to a protocol accumulating massive amounts of bad debt and potentially never recovering.

根据被问及的对象,围绕清算的情绪可能会有所不同。对于交易者和借款人来说,清算可能对他们的投资组合有害,并成为最终痛苦的根源。但清算在保持借贷市场健康方面也发挥着不可或缺的作用。如果清算激励措施的结构不合理,那么最坏的情况可能会导致协议积累大量坏账,并且可能永远无法恢复。

In protocols such as Aave and Compound, a position can become subject to liquidation if it drops below a certain health factor. For Compound, this is a function of the defined collateral factor for an asset, and in Aave, users are given a bit of cushion (between 5–20% depending on the asset) once their position passes the acceptable loan-to-value ratio. When a position qualifies for liquidation, up to 50% of the borrowed value can be repaid by a liquidator (this 50% is also known as the “close factor”). By taking on 50% of a user's liabilities, that liquidator also has a claim to the same amount of collateral value plus a protocol-defined liquidation incentive/discount (a flat 8% in Compound and a range from 4-10% in Aave). This indeed can be a pain point for borrowers, as they can see a substantial amount of their position wiped away in a single transaction. These fixed-rate liquidation incentives and close factors carry the benefit of a more predictable liquidation outcome, but this liquidation design doesn’t allow for the market to have a voice regarding the liquidation dynamics.

在 Aave 和 Compound 等协议中,如果仓位低于某个健康因子,则可能会被清算。对于 Compound,这是给资产定义的抵押因子的函数,在 Aave 中,一旦用户的头寸超过可接受的贷款价值比,他们就会获得一点缓冲(在 5-20% 之间,取决于资产)。当头寸符合清算条件时,清算人最多可以偿还借款价值的 50%(这 50% 也称为“平仓因子”)。通过承担用户 50% 的债务,该清算人还拥有相同数量的抵押品价值以及协议定义的清算激励/折扣(Compound 中为 8%,Aave 中为 4-10%) .对于借款人来说,这确实是一个痛点,因为他们可以看到他们的大量头寸在一次交易中被抹去。这些固定利率的清算激励和收盘因子带来的好处是更可预测的清算结果,但这种清算设计并不允许市场对清算动态有发言权。

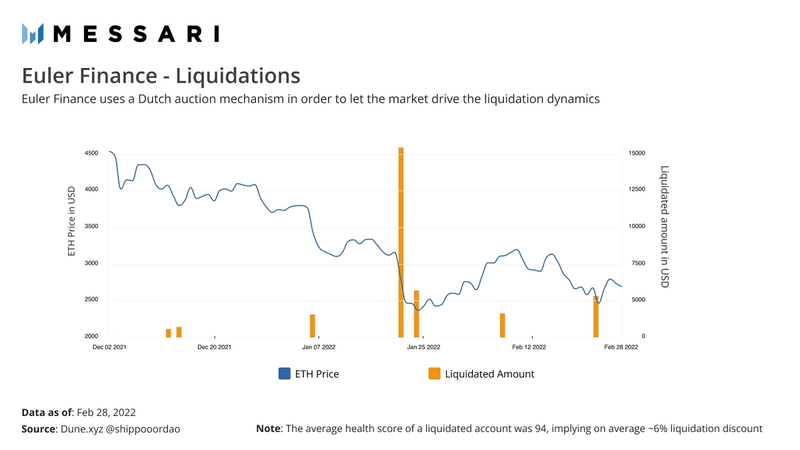

Euler has implemented what are referred to as “soft liquidations.” Rather than setting a flat close factor across all markets, liquidators can only remove enough debt and collateral in order to adjust a user's health factor to 1.25. The health factor is calculated as the ratio of risk-adjusted collateral value to risk-adjusted liabilities. As with Compound and Aave, Euler also has a liquidation incentive/discount. Rather than set these rates at a protocol or market level, Euler leverages a Dutch-auction style mechanism which allows the market to express itself in determining what the appropriate liquidation discount needs to be. The further away a user’s health factor drifts below 1, the larger the liquidation discount becomes (the liquidation discount is capped at 20%). Liquidators therefore can decide when it makes economic sense to carry out a liquidation transaction. Normally, liquidation bots compete with one another in hopes of having their respective liquidation transactions included in the next block, this typically results in contributing to maximal extractable value (MEV). Liquidation bots continue to increase the fees tied to their transactions, resulting in network congestion and increased transaction costs for the average user. Euler’s liquidation design philosophy should help avoid these scenarios where liquidators battle it out in the mempool via priority gas auctions.

Euler 实施了所谓的“软清算”。清算人不是在所有市场上设置一个平坦的收盘因子,而是只能移除足够的债务和抵押品,来将用户的健康因子调整到 1.25。健康因子计算为风险调整后的抵押品价值与风险调整后负债的比率。与 Compound 和 Aave 一样,Euler 也有清算激励/折扣。 Euler 不是在协议或市场级别设置这些费率,而是利用荷兰式拍卖机制,允许市场在确定适当的清算折扣时表达参与意愿。用户健康因子越低于 1,清算折扣越大(清算折扣上限为 20%)。因此,清算人可以决定何时进行清算交易才具有经济意义。通常,清算机器人相互竞争,希望将各自的清算交易包含在下一个区块中,这通常会导致最大可提取价值(MEV)。清算机器人继续增加与其交易相关的费用,导致网络拥塞并增加普通用户的交易成本。 Euler 的清算设计理念应该有助于避免清算人通过优先 gas 拍卖在内存池中互相对垒的情况。

Liquidators can also leverage stability pools within Euler which are associated with each market. Instead of outsourcing the upfront capital required for a liquidation event, liquidators can supply funds to a stability pool which can later be used to carry out liquidations. From the liquidators’ perspective, this should generally lower the total transaction costs for liquidations as the capital is sourced within the protocol itself, and there is only an internal price feed to be considered, compared with the scenario of sourcing capital from an external exchange. Additionally, liquidators who provide liquidity to these pools gain the benefit of a “liquidation discount booster,” which effectively increases the profit margins when calculating the total liquidation discount.

清算人还可以利用与每个市场相关的 Euler 内的稳定池。清算人无需外包(外借)清算事件所需的前期资金,而是可以向稳定池提供资金,该池以后可用于进行清算。从清算人的角度来看,这通常会降低清算的总交易成本,因为资金来自协议本身,并且与从外部交易所采购资金的情况相比,只需要考虑内部的价格推送。此外,为这些池提供流动性的清算人获得了“清算折扣助推器”的好处,这在计算总清算折扣时有效地增加了利润率。

流动性检查展期 (Deferred Liquidity Checks)

Typically when a user creates a transaction in a lending and borrowing protocol, the system will first perform a health check on the user's position. If the proposed transaction (for a simple example, this could be borrowing a certain token) would leave their position undercollateralized, then the transaction would not be allowed. This is necessary, of course, to keep the protocol solvent and healthy.

通常,当用户在借贷协议中创建交易时,系统将首先对用户的头寸进行健康检查。如果提议的交易(举个简单的例子,比如可能是借用某个代币)会使他们的头寸抵押不足,那么交易将不被允许。当然,这对于保持协议的流动性和健康是必要的。

But, imagine being able to bundle a set of actions such that the end result is ultimately a healthy position, but a particular action in the set may not be feasible on its own (e.g., attempting to borrow a token without proper collateralization). The savvy reader may recognize this (potentially complex) transaction description as a flash loan, popularized by Aave. In Euler, the notion of a deferred liquidity check is somewhat of a generalization of the flash loan concept. At a high level, a user is able to build up a transaction and defer the liquidity check on their position until the last action is taken. In protocols such as Aave, a flash loan comes with a small fee (currently set at 0.09%). Euler takes the position that these complex transactions should be free for users, so there is no associated fee when leveraging the deferred liquidity check functionality. Overall, this is a somewhat complex and abstract functionality, but since there are fewer limitations within Euler (i.e., no associated fee structure), users and developers will generally only be restricted by their own creativity.

但是,想象一下能够捆绑一组动作来使最终结果达到一个健康的位置,但该组中的特定动作本身可能是不可行的(例如,试图在没有适当抵押的情况下借用代币)。精明的读者可能会将这种(可能很复杂的)交易描述识别为由 Aave 推广的闪电贷款。在Euler中,流动性检查展期的概念在某种程度上是对闪电贷概念的概括。在较高级别上,用户能够建立交易并将对其头寸的流动性检查推迟到采取最后行动。在 Aave 等协议中,闪电贷需要支付少量费用(目前设定为 0.09%)。 Euler 认为这些复杂的交易应该对用户免费,因此在利用延迟流动性检查功能时不会产生相关费用。总的来说,这是一个有点复杂和抽象的功能,但由于Euler内部的限制较少(即没有相关的费用结构),用户和开发人员通常只会受到他们自己的创造力的限制。

EUL经济学 (EUL Tokeneconomics)

The protocol’s native token is EUL, which has yet to be released. EUL holders will have the ability to vote on governance proposals (in Euler’s recently announced governance forum), manage the protocol-owned liquidity, reserves, and treasury. There will also be the ability for EUL holders to stake their tokens, which will earn rewards and also serve as a backstop to the protocol.

该协议的原生代币是 EUL,尚未发布。 EUL 持有者将能够对治理提案进行投票(在 Euler 最近宣布的 治理论坛中),管理协议拥有的流动性,储备金和国库。 EUL 持有者也将有能力抵押他们的代币,这将获得奖励并作为协议的支持。

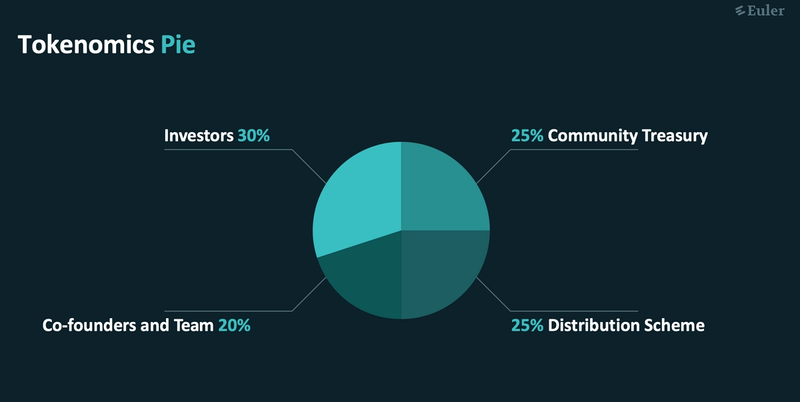

The max supply of EUL is 27,182,818.284590452353602874, which can be further adjusted after the initial 4 year distribution schedule via governance. The max supply of EUL is of course not an arbitrary value; it’s a symbol and hat tip to Euler’s number which is a widely used constant in many areas of mathematics. The allocation of the tokens will be split between investors, founders and team members, a community treasury, and an initial community distribution mechanism.

EUL 的最大供应量为 27,182,818.284590452353602874,在最初的 4 年分配计划之后,可以通过治理进一步调整。 EUL 的最大供应量当然不是任意值;它是Euler数的符号和帽子提示,Euler数是许多数学领域中广泛使用的常数。代币的分配将在投资者、创始人和团队成员、社区金库和初始社区分配机制之间进行分配。

(来源: Euler XYZ 团队 Source: Euler XYZ Team)

Investor allocations have an 18 month linear vesting schedule with no cliff, and founders have a 48 month linear vesting schedule with no cliff. Team members have a non-linear vesting schedule which follows the pattern of 10% vest after 1 year, 20% of the remaining allocation vests after 2 years, 30% of the remaining allocation vests after 3 years, and the remaining vests after 4 years.

投资者分配有 18 个月的线性归属时间表,没有最短生效期,创始人有 48 个月的线性归属时间表,没有最短生效期。团队成员有一个非线性归属时间表,遵循 1 年后归属 10%,2 年后归属剩余分配 20%,3 年后归属剩余分配 30%,4 年后归属剩余分配的模式.

Euler has put together an interesting initial distribution scheme for the community to participate in. The EUL token will be distributed every 100,000 blocks across a variety of markets on the Euler platform. In particular, the distribution will only be on the borrowing side, there will be no distribution for solely supplying assets. The Euler core team will determine the initial set of markets which will be included in this distribution scheme, including USDC, WETH, DAI, and WBTC. The distribution rate will be non-linear over 4 years, with the initial inflation rate set at ~3%, peaking around ~14% after 18 months, then flattening out around ~2.718% at the 4 year mark.

Euler 制定了一个有趣的初始分配方案供社区参与。EUL 代币将在 Euler 平台上的各个市场上每 100,000 个区块分配一次。特别是,分配只会在借款方,不会仅用于提供资产的分配。 Euler 核心团队将确定将包含在此分配方案中的初始市场设定,包括 USDC、WETH、DAI 和 WBTC。分配率将在 4 年内呈非线性变化,初始通货膨胀率设定为约 3%,18 个月后达到约 14% 的峰值,然后在 4 年时趋于平缓约 2.718%。

Euler’s distribution scheme will leverage the gauge concept in order to determine the flow of EUL tokens across the various involved markets. EUL holders can stake their EUL against their preferred market in order to drive EUL distribution there, and stakers are not subject to lock-up periods that protocols such as Curve utilize. The gauges will be designed such that EUL tokens are distributed in proportion to the square root of the amount of EUL staked for that market. This function will allow the EUL distribution within a particular market to smooth out once it’s weighted heavier relative to the other markets and will then also disincentivize staking in over-saturated markets.

Euler 的分配方案将利用计量概念来确定 EUL 代币在各个相关市场中的流动。 EUL 持有者可以将他们的 EUL 抵押到他们最属意的市场,并推动 EUL 在那里的分配,并且抵押者不受 Curve 等协议使用的锁定期的约束。计量器的设计使 EUL 代币按该市场质押的 EUL 数量的平方根的比例分配。此功能将允许特定市场内的 EUL在其权重相对于其他市场较重时分配变得平滑,然后还将抑制在过度饱和市场中的质押。

This approach serves as a more targeted method of EUL token distribution rather than simply distributing EUL to both lenders and borrowers in every market. While lenders won’t be eligible to participate in this EUL distribution, they’ll receive indirect benefits. Borrowing will essentially be subsidized by the EUL distribution, which should increase overall borrowing demand on the platform, leading to increased yield for lenders.

这种方法是一种更有针对性的 EUL 代币分配方法,而不是简单地将 EUL 分配给每个市场的贷方和借方。虽然贷方没有资格参与此 EUL 分配,但他们将获得间接收益。借款基本上将由 EUL 分配补贴,这将增加平台上的整体借款需求,从而提高贷方的收益。

现在和未来 (Today and the Road Ahead)

Euler currently has ~$85 million total in deposits, ~$34 million in outstanding loans, and has accumulated ~$66 thousand in protocol revenue since its launch in mid-December 2021. If Euler can successfully increase deposits, then this will lower the interest rates for the marginal borrower, ultimately resulting in more protocol revenue. Regarding interest rate models, Euler currently uses the traditional kink model found in both Aave and Compound but has plans to move towards a more algorithmically reactive interest rate framework which will leverage control theory concepts.

Euler 目前的存款总额约为 8500 万美元,未偿还贷款约为 3400 万美元,自 2021 年 12 月中旬推出以来,协议收入已累计约为 6.6 万美元。如果 Euler 能够成功增加存款,那么这将为借款人降低边际利率,最终导致更多的协议收入。关于利率模型,Euler 目前使用 Aave 和 Compound 中的传统kink模型,但计划转向更具算法回应性的利率框架,该框架将利用控制理论概念。

As Euler continues to grow, it will also look to diversify both the supply and borrow sides of the protocol. USDC is by far the most supplied and borrowed asset, accounting for ~75% of both the total supplied and borrowed assets. On the USDC supply side, the top 10 suppliers account for ~50% of the total USDC supply, and the top 10 borrowers account for ~66% of borrowed USDC. After USDC, WETH is the most supplied and borrowed asset, making up ~13% on the total supply side and ~18% on the borrow side. The top two WETH suppliers account for ~45% of the total supplied WETH, and the top two borrowers account for ~55% of borrowed WETH.

随着 Euler 的不断发展,它还将寻求使协议的供应方和借款方多样化。 USDC 是迄今为止供应和借入最多的资产,占总供应和借入资产的 75% 左右。在 USDC 供应方面,前 10 名供应商占 USDC 总供应量的约 50%,前 10 名借款人占借入 USDC 的约 66%。在 USDC 之后,WETH 是供应和借入最多的资产,占总供应方约 13% 和借入方约 18%。排名前两位的 WETH 供应商占 WETH 总供应量的 45%,排名前两位的借款人占所借 WETH 的 55%。

Being a nascent protocol, Euler will likely look to grow by going after the marginal lender/borrower of longer tail assets, and also by developing integrations with other DeFi protocols. Euler has designed its platform to tokenize supplied assets (i.e., eTokens) as well as debt, in the form of dTokens. Tokenizing debt and allowing it to be transferable is a subtle feature, but it should allow for complex, leveraged positions to be built up which users and protocols may take advantage of. Naturally, Euler will continue competing with protocols such as Rari, Aave, and Compound, and also with new lending and borrowing protocols which are sprouting up across other L1s.

作为一个新兴协议,Euler 可能会通过追求长尾资产的边际出借方/借款人以及开发与其他 DeFi 协议的集成来实现增长。 Euler 设计了其平台,以代币的形式对提供的资产(即 eToken)和债务(即dToken)进行标记。将债务代币化并使其可转移是一个微妙的功能,但应该允许建立复杂的杠杆头寸,用户和协议则可以利用这些头寸。自然地,Euler 将继续与 Rari、Aave 和 Compound 等协议竞争,并且还会与其他 L1 中涌现的新借贷协议竞争。

The incumbents will also look to expand their portion of the lending and borrowing market. To this end, Aave V3 was announced towards the end of 2021 and has now been deployed across six networks. While there are numerous new features introduced, the portal and isolation mode additions appear to be most relevant when analyzing the overall design architecture between Aave and Euler. The portal feature will allow Aave to increase its capital efficiency across the various implementations of the protocol. Aave will look to integrate with select bridges, allowing their aTokens to be transferred seamlessly from network to network. In short, this should allow value within Aave to flow more freely between different networks, unifying what is typically considered fragmented liquidity. Aave’s isolation mode effectively combines some of the components of Euler’s asset tier functionality. As new assets are onboarded into Aave, they can be listed in isolation mode. Unlike in Euler, assets in Aave’s isolation mode can be leveraged as collateral, but governance-approved stablecoins are the only borrowable assets and they will also have associated borrow caps.

现有项目也还将寻求扩大其在借贷市场的份额。为此,Aave V3 于 2021 年底宣布,现已部署在六个网络中。虽然引入了许多新功能,但在分析 Aave 和 Euler 之间的整体设计架构时,其添加的门户和隔离模式似乎最相关。门户功能将允许 Aave 在协议的各种实现中提高其资本效率。 Aave 将寻求与选定的跨链桥集成,允许它们的 aToken 在网络之间无缝传输。简而言之,这应该允许 Aave 内的价值在不同网络之间更自由地流动,尝试统一通常被认为是分散的流动性。 Aave 的隔离模式有效地结合了 Euler 资产层功能的一些组件。随着新资产加入 Aave,它们可以用隔离模式列出。与 Euler 不同,Aave 隔离模式下的资产可以用作抵押品,但治理批准的稳定币是唯一可借用的资产,它们也会有相关的借用上限。

Although using Uniswap V3 TWAPs for asset pricing allows Euler to develop a logical risk management framework, it also creates a technical dependency on Uniswap V3. Euler currently is only deployed on Ethereum mainnet, which has become increasingly unusable for the average individual due to high transaction costs. Uniswap on the other hand has instances on Ethereum mainnet, Arbitrum, Optimism, and Polygon. Therefore, as Euler grows as a protocol and expands its footprint across other networks, it will already have a critical component of its system in place. Importantly, Euler will not only have to consider where Uniswap V3 is deployed, but there also needs to be significant traction and proper liquidity profiles for assets on these networks.

尽管使用 Uniswap V3 TWAP 进行资产定价允许 Euler 开发逻辑风险管理框架,但它也创建了对 Uniswap V3 的技术依赖。 Euler 目前仅部署在以太坊主网上,由于高昂的交易成本,该主网上对于普通个人来说变得越来越不可用。另一方面,Uniswap 在以太坊主网、Arbitrum、Optimism 和 Polygon 上有实例。因此,随着 Euler 作为一种协议发展并在其他网络中扩展其足迹,它已经拥有其系统的关键组件。重要的是,Euler不仅需要考虑 Uniswap V3 的部署位置,而且还需要为这些网络上的资产提供强大的牵引力和适当的流动性配置文件。

In order to continue protocol growth, Euler will look to deploy on networks where Uniswap V3 exists and where it is deployed in the future, giving it a first-mover advantage over competing protocols. Given this advantage, Euler may see significant growth, especially because the project launched during a period of rapid decrease in leverage demand. In addition, borrowing will be subsidized when the initial EUL token is distributed. In any case, Euler will continue to develop its product and work towards growing its user base as it seeks to find its place within the lending and borrowing space.

为了协议继续增长,Euler 将寻求在 Uniswap V3 所在的网络以及未来部署的网络上进行部署,使其在竞争协议中具有先发优势。鉴于这一优势,欧拉可能会出现显着增长,特别是因为该项目在杠杆需求快速下降期间启动。此外,在分发初始 EUL 代币时,借款将得到补贴。无论如何,欧拉将继续开发其产品并努力扩大其用户群,以寻求在借贷领域中找到自己的位置。

This report was commissioned by Euler, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in the Hub does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report and each author is subject to Messari’s Code of Conduct and Insider Trading Policy. Additionally, employees are required to disclose their holdings, which is updated monthly and published here. Crypto projects can commission independent research through Messari Protocol Services. For more details or to join the program, contact hub@messari.io. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our terms of use for more information.

本报告由 Protocol Services 成员 Euler 委托编写。所有内容均由作者独立制作,并不一定反映 Messari, Inc. 或要求报告的组织的意见。该中心的付费会员不影响编辑决定或内容。作者可能持有本报告中指定的加密货币,每位作者均受 Messari 行为准则和内幕交易政策的约束。此外,员工必须披露其持有的资产,该资产每月更新并在此处 发布。加密项目可以通过 Messari 协议服务委托独立研究。如需了解更多详情或加入该计划,请联系 hub@messari.io。本报告仅供参考。它不是作为投资建议。在做出任何投资决定之前,您应该进行自己的研究,并咨询独立的财务、税务或法律顾问。任何资产的过往表现并不代表未来的结果。请参阅我们的使用条款了解更多信息。