原文:https://blog.euler.finance/introducing-euler-8f4422f13848

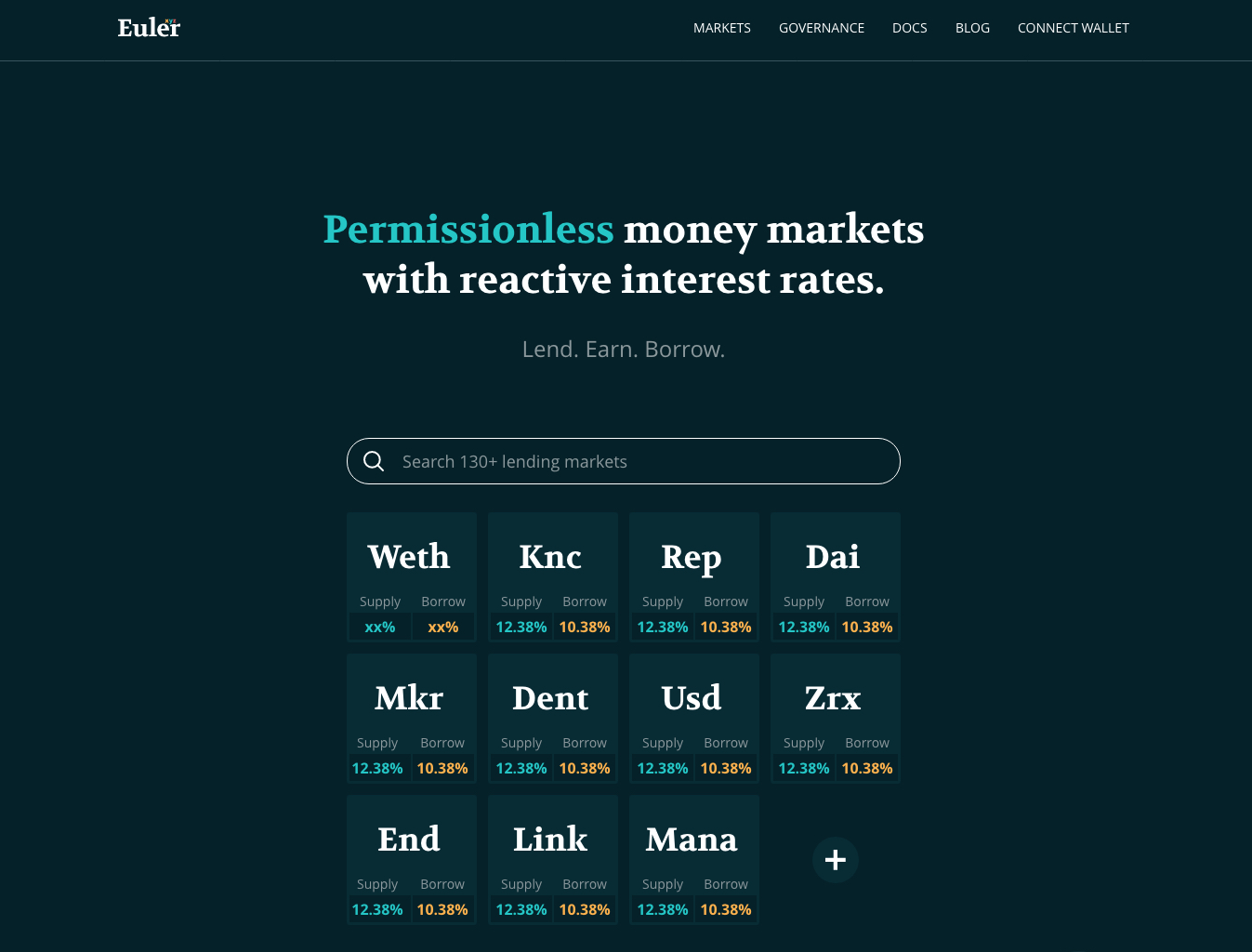

The latest innovation in decentralised finance: a permissionless lending protocol with reactive interest rates to address the long-tail of the crypto market.

去中心化金融的最新创新:一种具有回应式利率的无许可借贷协议,以解决加密市场的长尾问题。

我们的旅程 (Our journey)

Euler XYZ started out by winning Encode Club’s ‘Spark’ University Hackathon. In doing so, we beat over 100+ teams from universities across the world to take the prize. You can read more about the hackathon here.

Euler XYZ 一开始就赢得了 Encode Club 的“Spark”大学黑客马拉松。在此过程中,我们击败了来自世界各地大学的 100 多个团队获得了奖项。您可以在 此处 阅读有关黑客马拉松的更多信息。

Today, we are delighted to announce that we have closed an $800k seed round led by Lemniscap. The round includes other leading funds LAUNCHub Ventures, CMT Digital, Divergence Ventures, Block0 and Cluster, as well as influential angels Luke Youngblood of Coinbase, Richard Burton and Josh Buckley, CEO of Product Hunt.

今天,我们很高兴地宣布,我们已经完成了由 Lemniscap 领投的 80 万美元种子轮融资。本轮融资包括其他领先基金 LAUNCHub Ventures、CMT Digital、Divergence Ventures、Block0 和 Cluster,以及来自 Coinbase 有影响力的天使 Luke Youngblood,Richard Burton 和 Product Hunt 首席执行官 Josh Buckley。

我们是谁 (Who are we?)

Euler XYZ was founded by Dr Michael Bentley (previously post-doc in Mathematical Biology at the University of Oxford), Jack Leon Prior (experienced full stack developer) and Doug Hoyte (experienced solidity developer).

We are also very proud to have onboard Mick de Graaf from PieDAO in an advisory capacity.

Euler XYZ 由 Michael Bentley 博士(之前是牛津大学数学生物学博士后)、Jack Leon Prior(经验丰富的全栈开发人员)和 Doug Hoyte(经验丰富的 Solidity 开发人员)。

我们也很自豪能够有 PieDAO 的 Mick de Graaf以顾问身份加入。

(从左至右: Michael Bentley博士, Jack Leon Prior, Doug Hoyte and advisor Mick de Graaf)

Euler是什么? (What is Euler?)

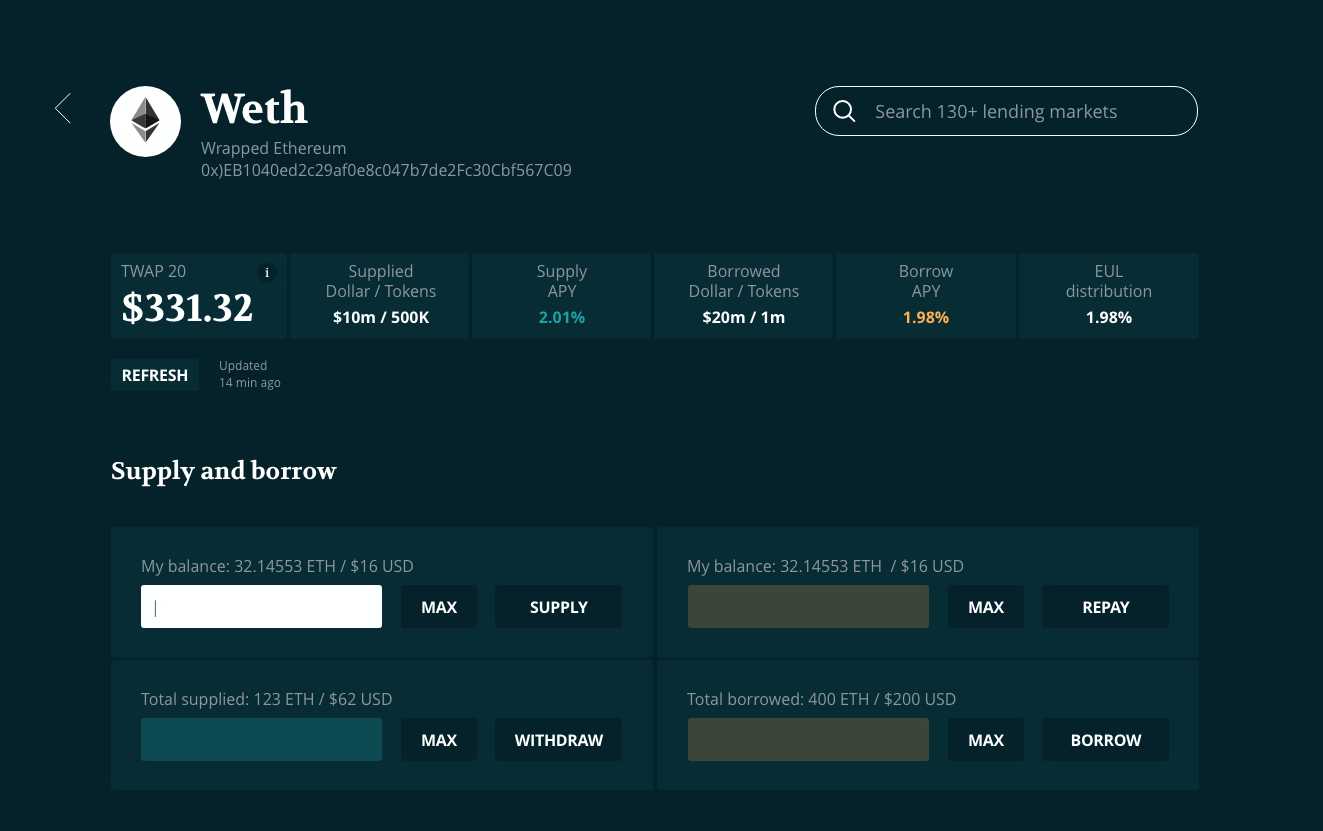

Euler protocol builds upon the foundations of other popular money market protocols like Compound and Aave, but allows users to create their own markets for any Ethereum ERC20 token and features innovative reactive interest rate models backed by control theory that reduce the need for governance intervention in rapidly moving markets.

Euler 协议建立在 Compound 和 Aave 等其他流行货币市场协议的基础之上,但允许用户为任何以太坊 ERC20 代币创建自己的市场,并具有由控制理论支持的创新回应式利率模型,可减少快速变化的市场中要求治理进行干预的需求。

动机 (Motivation)

Money markets now contribute billions of dollars of total value locked to the burgeoning decentralised finance (DeFi) ecosystem, allowing users to earn interest on their assets.

货币市场现在为蓬勃发展的去中心化金融(DeFi)生态系统贡献了数十亿美元的总价值,允许用户从他们的资产中赚取利息。

However, access remains limited to a handful of money markets for a few of the most liquid assets. Increasing access to money markets for more tokens poses a number of challenges that existing protocols were not designed to address.

然而,入口仍然仅限于少数几个流动性最强的资产对应的货币市场。为更多代币增加进入货币市场的机会,带来了许多现有协议无法解决的挑战。

Euler is a non-custodial protocol custom-built for the long-tail of the market. Several features set Euler apart from other popular money market protocols.

Euler 是一种为长尾市场定制的非托管协议。 Euler 与其他流行的货币市场协议有几个特点。

List any asset: powered by Uniswap’s decentralised time-weighted average price oracles, Euler is allowing users to create their own lending/borrowing markets for almost any Ethereum ERC20 token.

任何资产都可以公开上币: 有 Uniswap 的 去中心化时间加权平均价格预言机提供支持,Euler 允许用户为几乎任何以太坊 ERC20 代币创建自己的借贷市场。

Risk-minimised: Euler secures the protocol by tailoring the borrowing capacity of users to the risk profiles associated with the assets they want to borrow and use as collateral.

风险最小化: Euler通过调整用户的借贷能力以适应与其欲借入和抵押资产相关风险状况来保护协议。

Reactive interest rates: interest rate models backed by control theory ensure that money markets on Euler adapt to volatile market conditions in real-time without the need for governance intervention.

回应性利率: 由控制理论支持的利率模型可确保Euler货币市场实时适应波动的市场条件,而无需治理干预。

理论 (The Theory)

Aave/Compound利率 (Aave/Compound interest rates):

Euler利率 (Euler interest rates):

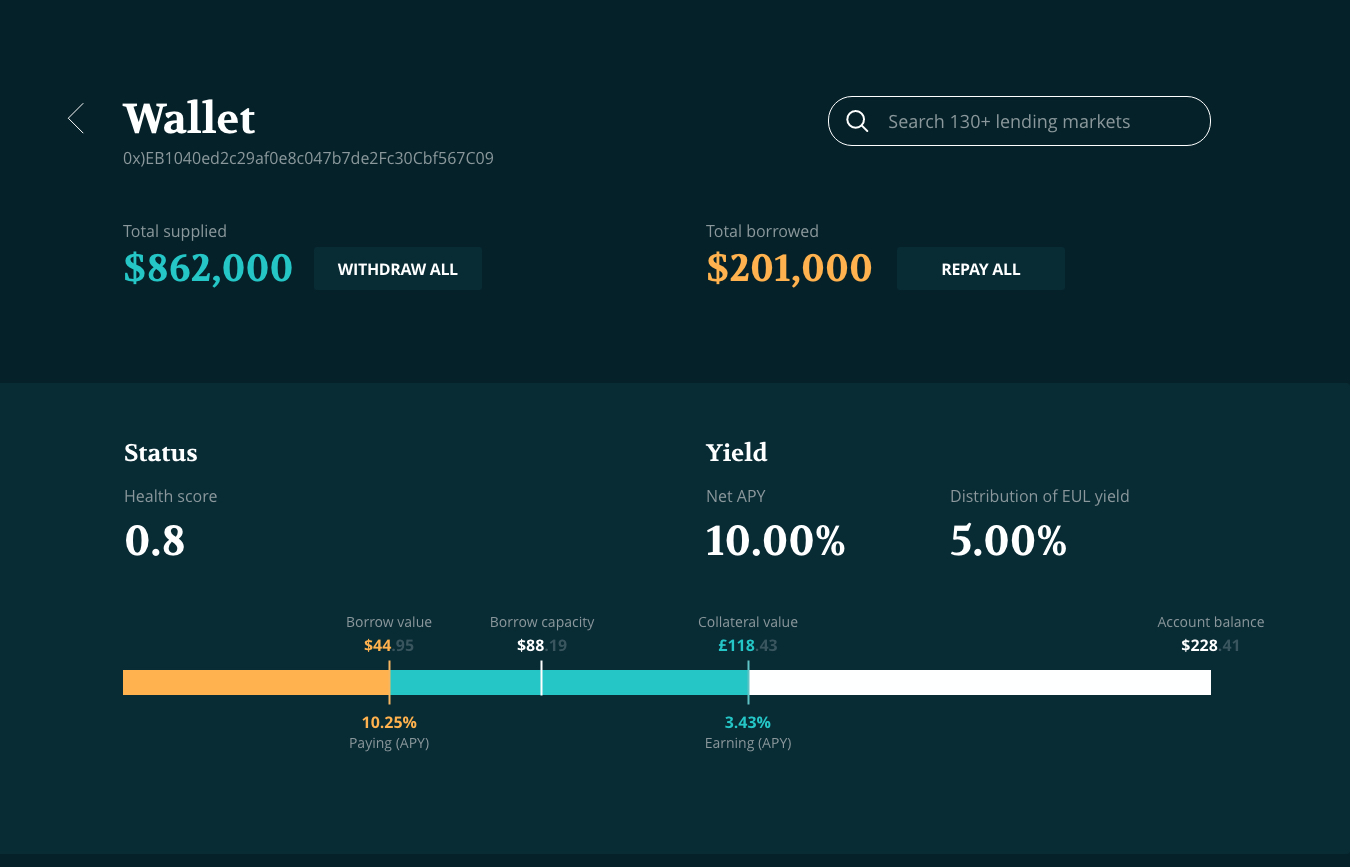

Eul支持的EulerDAO (EulerDAO powered by EUL)

Euler will be governed in the long-term by a decentralised autonomous organisation: EulerDAO. Voting rights will be determined by ownership of a community governance token (EUL). Fees generated by Euler protocol will accrue to EUL token holders. Details of the token supply and distribution will be announced in due course.

Euler 将长期由一个去中心化的自治组织 EulerDAO 管理。投票权将由社区治理代币(EUL)的所有权决定。 Euler 协议产生的费用将归于 EUL 代币持有者。代币供应和分配的细节将在适当时候公布。

Roadmap

We will soon be recruiting engaged community members to help us test an alpha version of the protocol. Details to be released in the coming weeks. Early ambassadors will be rewarded for their participation and feedback with EUL tokens, so keep an eye out!

我们将很快招募参与的社区成员来帮助我们测试协议的 alpha 版本。详细信息将在未来几周内公布。早期大使的参与和反馈将获得 EUL 代币奖励,因此请密切注意!

Join our Discord, sign up for news on our website and subscribe to our social channels below.

Euler V1 will be launched in Q1 2021, once we have collated feedback from the community and secured the necessary code audits.

加入我们的 Discord,在我们的网站上注册并在下方订阅我们的社交频道。

当我们整理了来自社区的反馈并确保了必要的代码审核,Euler V1 将于 2021 年第一季度推出,

来加入讨论吧 (Come and join the discussion)

Visit our website, join our Discord, and follow us on Medium, Twitter, and Telegram.

Our repos are currently private, but you can also follow us on GitHub.

访问我们的 网站,加入我们的 Discord,并在 Medium Twitter 和 Telegram上关注我们。

我们的存储库目前是私有的,但您也可以在 GitHub 上关注我们。

如何参与 (Get involved)

Euler XYZ are always on the lookout for talented individuals to help us grow. Solidity developer? DeFi virtuoso? Governance specialist? Reach out to careers@euler.xyz, we’d love to hear from you.

All the best,

Euler XYZ 一直在寻找有才华的人来帮助我们成长。 Solidity 开发人员? DeFi 大师?治理专家?联系 careers@euler.xyz,我们很乐意听取您的意见。

祝一切顺利,

Michael Bentley博士, CEO