Users can learn the basics of depositing, borrowing, repaying and withdrawing assets on the Euler dApp.

用户可以在Euler dApp上学习以下关于资产的基础知识:存款、借出、还款、提款。

As part of the Euler User Guide series, and after getting more familiar with the Euler UI, users can learn some of the core functions on Euler in this latest guide on borrowing and lending.

作为 Euler 用户指南 系列的一部分,在更熟悉 Euler UI 后,用户可以在本最新的借贷指南中了解 Euler 的一些核心功能。

This article serves to help as an educational guide on utilising the Euler platform to borrow and lend, and is not financial advice.

本文是辅助使用 Euler 平台借贷的操作手册,而不是财务建议。

The screenshots below make use of Euler’s Ropsten testnet where users can practice and learn using testnet tokens. Users unfamiliar with testnets can read this guide or watch this video.

以下使用的屏幕截图使用了 Euler 的 Ropsten 测试网,用户可以在其中练习和学习使用测试网代币。不熟悉测试网的用户可以阅读这个指南 或观看[视频](https://www.youtube.com/watch?v= _RlaKSIkF40)。

借贷指南 (Borrowing and Lending Guide)

存款 (Deposit)

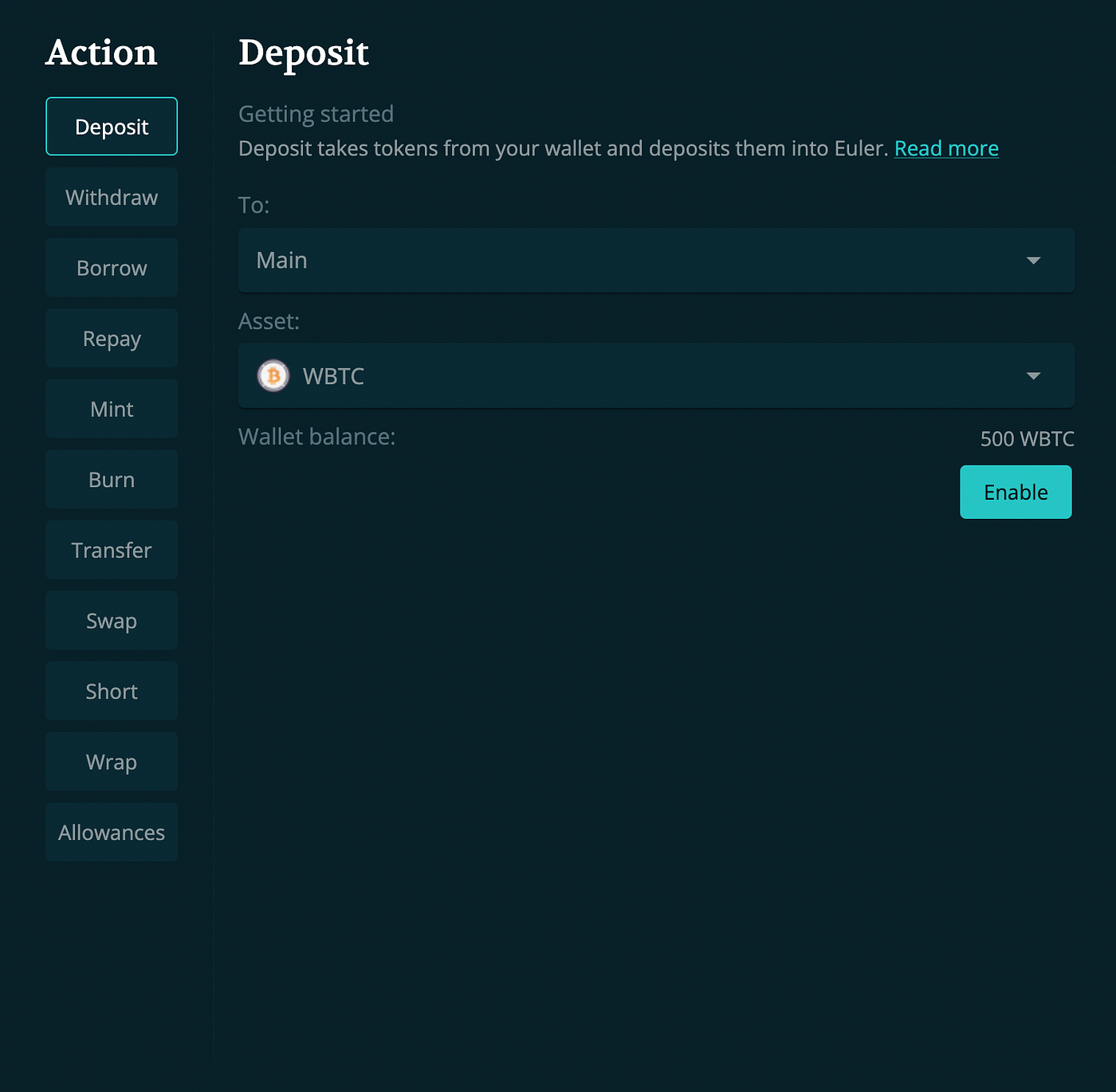

In the Euler dApp (testnet), click on the Quick Action button. Click on the Deposit tab, if it’s not already selected. Users can decide which account/subaccount to use and the asset they want to deposit.

在 Euler dApp (testnet) 中,单击“快速操作(Quick Action) ”按钮。如果尚未选择,请单击“存款(Deposit)”选项卡。用户可以决定使用哪个账户/子账户,以及他们想要存款的资产。

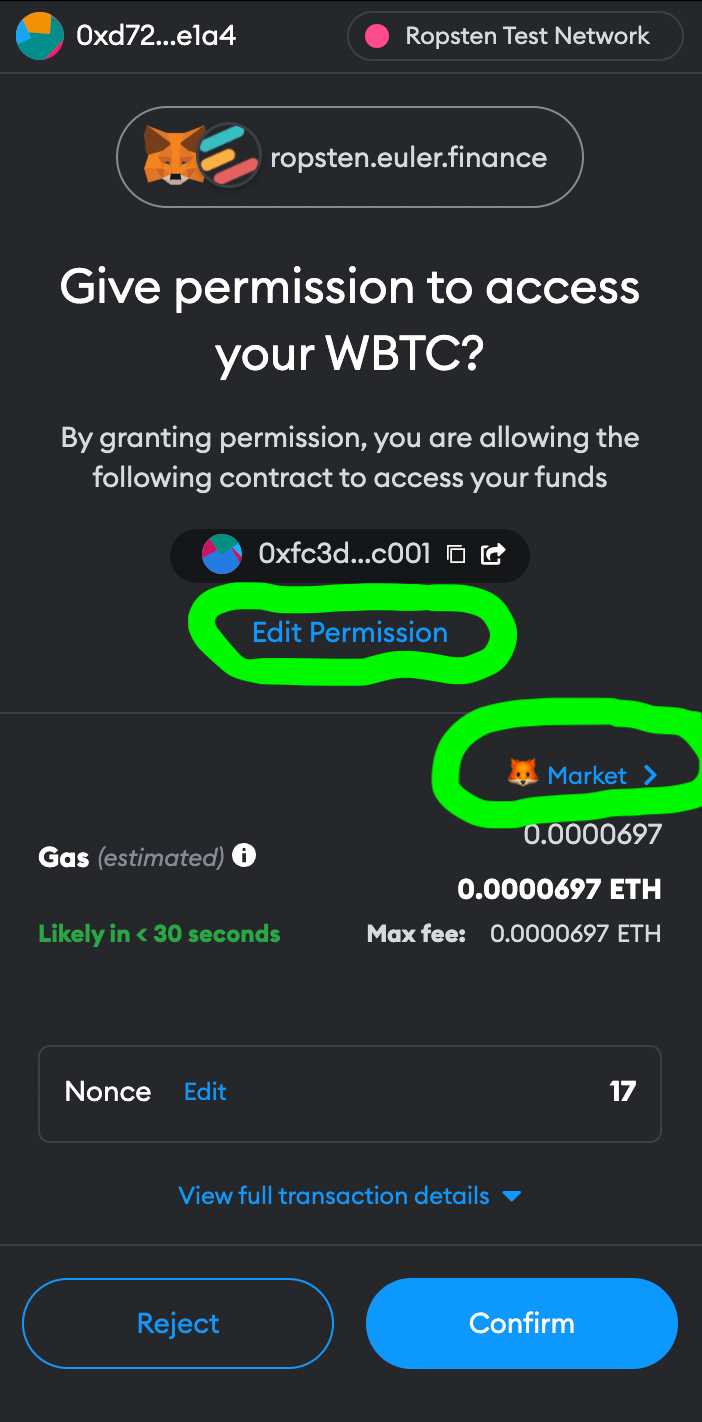

After deciding on an account and asset, click on the Enable button to give the Euler dApp permission to access the selected asset. Users can change their gas settings or even the amount of tokens the dApp has access to through the Edit Permission button. Hit confirm.

确定帐户和资产后,单击“激活(Enable)”按钮以授予 Euler dApp 访问所选资产的权限。用户可以通过 “编辑许可(Edit Permission)" 按钮更改他们的 gas 设置,甚至是dApp可以访问的代币数量。随后点击"确认(confirm)"。

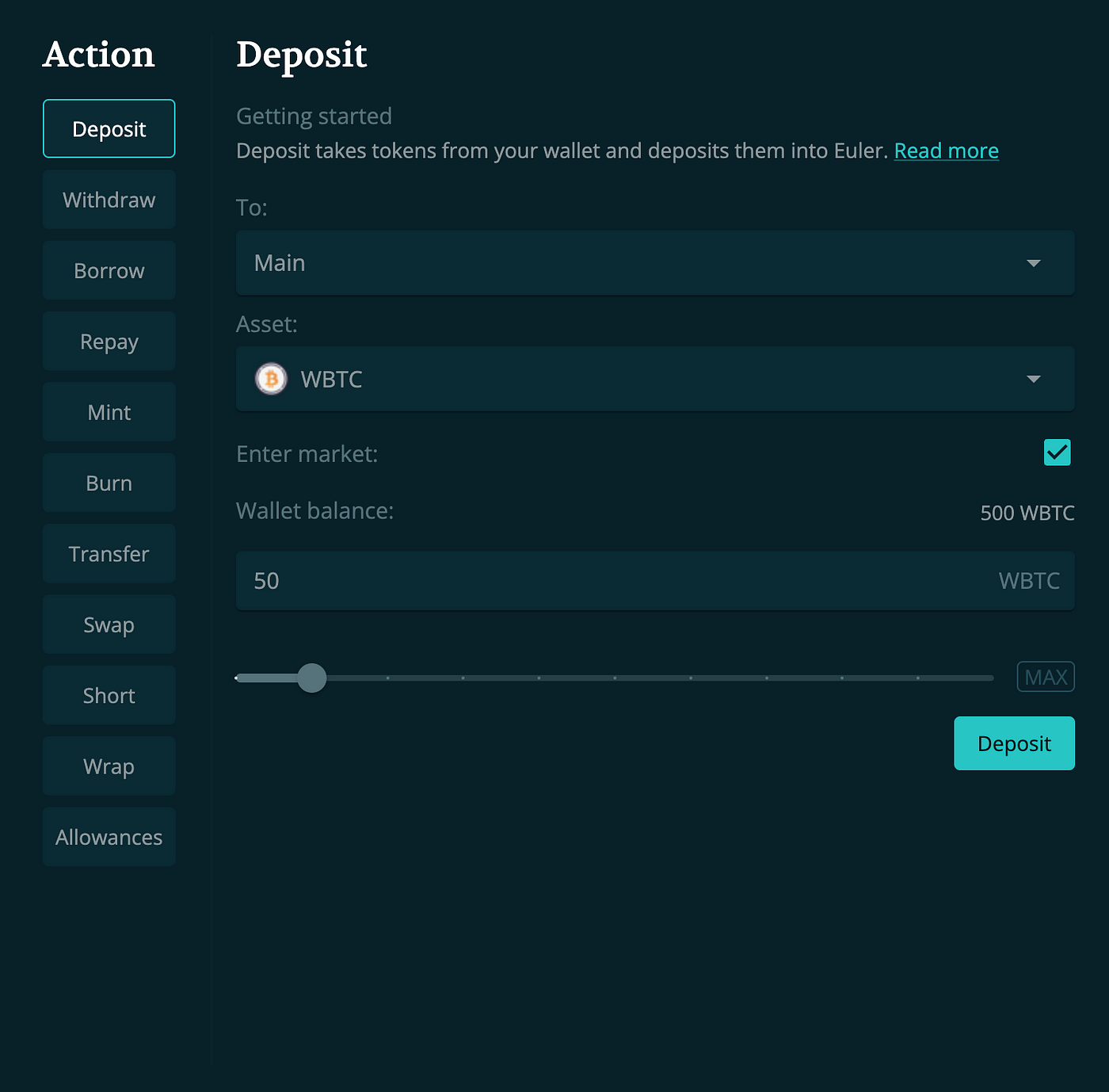

After the transaction processes, users can decide how many tokens they want to deposit. Use the slider or enter the desired amount and click the Deposit button. The Enter Market check box enables your deposited asset to become collateral. You can turn this on/off in the account page too.

交易完成后,用户可以决定他们想要存款多少代币。使用滑块或输入所需金额,然后单击“存款(Deposit)”按钮。"进入市场(Enter Market)"复选框使您存款的资产成为抵押品。您也可以在帐户页面中打开/关闭此功能。

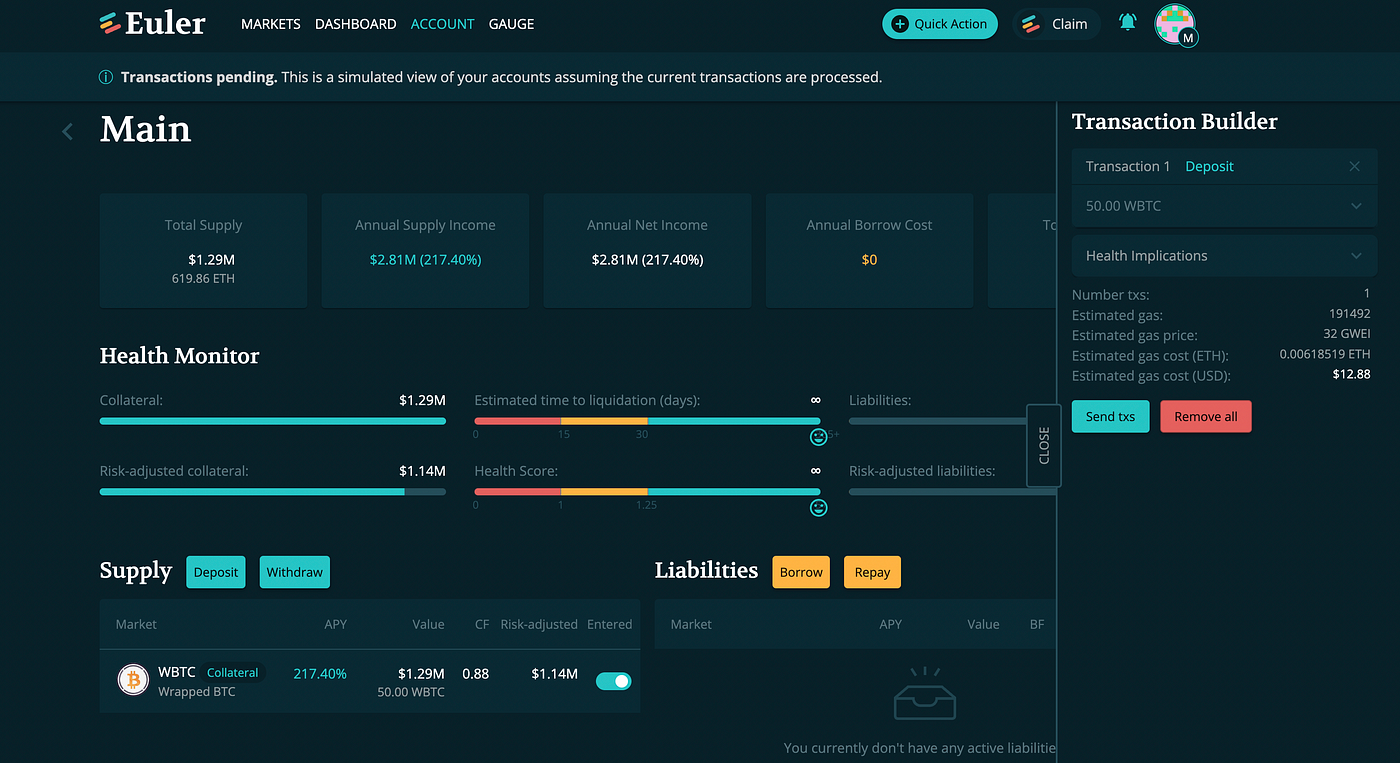

Users will see the Quick Action menu dissapear and their deposit request sent to the Transaction Builder on the right side of the screen.

用户将看到“快速操作(Quick Action)”菜单消失,并且他们的存款请求被发送到屏幕右侧的“交易生成/构建器(Transaction Builder)”。

By navigating to the Dashboard or Account page with the Transaction Builder open, users can see a simulated view of their accounts assuming the latest deposit request is processed. Cancelling the request by clicking on Remove All in the Transaction Builder will terminate the simulated view.

在“交易生成/构建器(Transaction Builder)”打开的情况下,通过导航到仪表板或账户页面,用户可以看到假设最新存款请求被处理之后,对应账户的模拟视图。可以单击“交易生成/构建器(Transaction Builder)”中的 “移除所有(Remove All)” 来取消请求,这将终止模拟视图。

The assets will deposit into the user’s account once the transaction has successfully processed.

交易成功处理后,资产将存款用户的账户。

借入 (Borrow)

In order to borrow other assets, users must have deposited a collateral tier asset. Not every crypto asset is qualified to be a collateral tier asset, so check the asset’s tier on the main page’s asset table.

为了借入其他资产,用户必须存款抵押层资产。并非所有加密资产都有资格成为抵押层资产,因此请在主页的资产表中查看资产的层级。

Note that non-collateral tier assets can be borrowed if its the same asset deposited (self collateralisation), but more on that in another guide.

请注意,如果存放了相同的资产(自我抵押),则可以借用非抵押层资产,但在另一个指南中对此进行了更多说明。

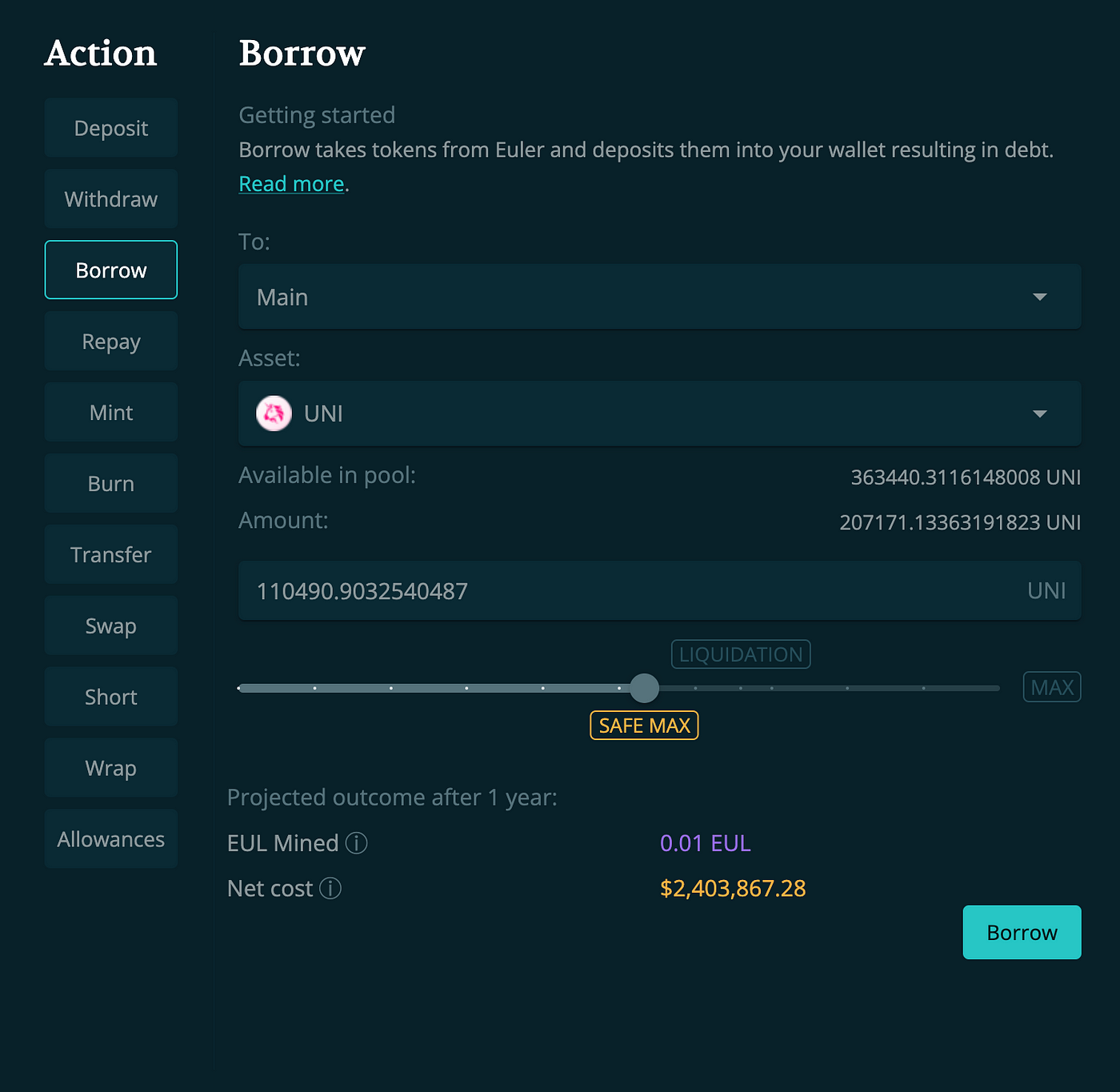

Go to the Quick Action menu, select Borrow and choose the account to use and asset to borrow. Decide on the amount of tokens to borrow but take note of the Safe Max, Liquidation, and Max selectors on the sliders. Going past the Liquidation value will liquidate the user’s collateral.

转到"快速操(Quick Action)"作菜单,选择"借入(Borrow)"并选择要使用的帐户和欲借入的资产。决定要借入的代币数量,但请注意滑块上的安全最大值(Safe Max)、清算(Liquidation)和最大值选择器(Max selectors)。超过清算价值会清算用户的抵押品。

If the asset is eligable to receive EUL tokens for mining, the values and costs will be shown at the bottom. Click the Borrow button to continue.

如果资产有资格获得 EUL 代币进行挖矿,价值和成本将显示在底部。单击"借入(Borrow)"按钮继续。

Just like in the depositing steps, users can see a simulated view of how the borrow will impact their acccounts on the Dashboard and Account pages.

就像在存款步骤中一样,用户可以在仪表板和帐户页面上看到借款将如何影响其帐户的模拟视图。

Users can see their health score and estimated time to liquidation (TTL) to see how close the position would be to being liquidated. If the health score and TTL are undesirable, the user can cancel the transaction request in the Transaction Builder by selecting Remove All and starting over again.

用户可以查看他们的健康评分和预计清算时间 (TTL),以了解该头寸离被清算的距离长短。如果运行状况评分和 TTL 不理想,用户可以通过选择 “移除所有(Remove All)”并重新开始来取消 “交易生成/构建器(Transaction Builder)” 中的交易请求。

Users should also consider the TTL and Health Score are calculated at current prices and interest rates. If the prices and interest rates of the deposited and borrowed assets change, these values will also change.

用户还应考虑 TTL 和健康评分,都是按当前价格和利率计算的。如果存款和借入资产的价格和利率发生变化,这些值也会发生变化。

Once the user has finalised their borrowing decisions, they can select the Send txs button in the Transaction Builder to proceed and confirm the transaction.

用户完成借款决定后,他们可以选择 “交易生成/构建器(Transaction Builder)”中的 "发送交易(Send txs)" 按钮来继续并确认交易。

Once the transaction has processed, the borrowed asset will appear in the account’s liabilities section. The user can find the borrowed asset in their wallet.

交易处理完毕后,借入的资产将出现在账户的负债部分。用户可以在他们的钱包中找到借来的资产。

TIP: Users can deposit borrowed assets back into Euler!

提示:用户可以将借来的资产存回欧拉!

还款 (Repay)

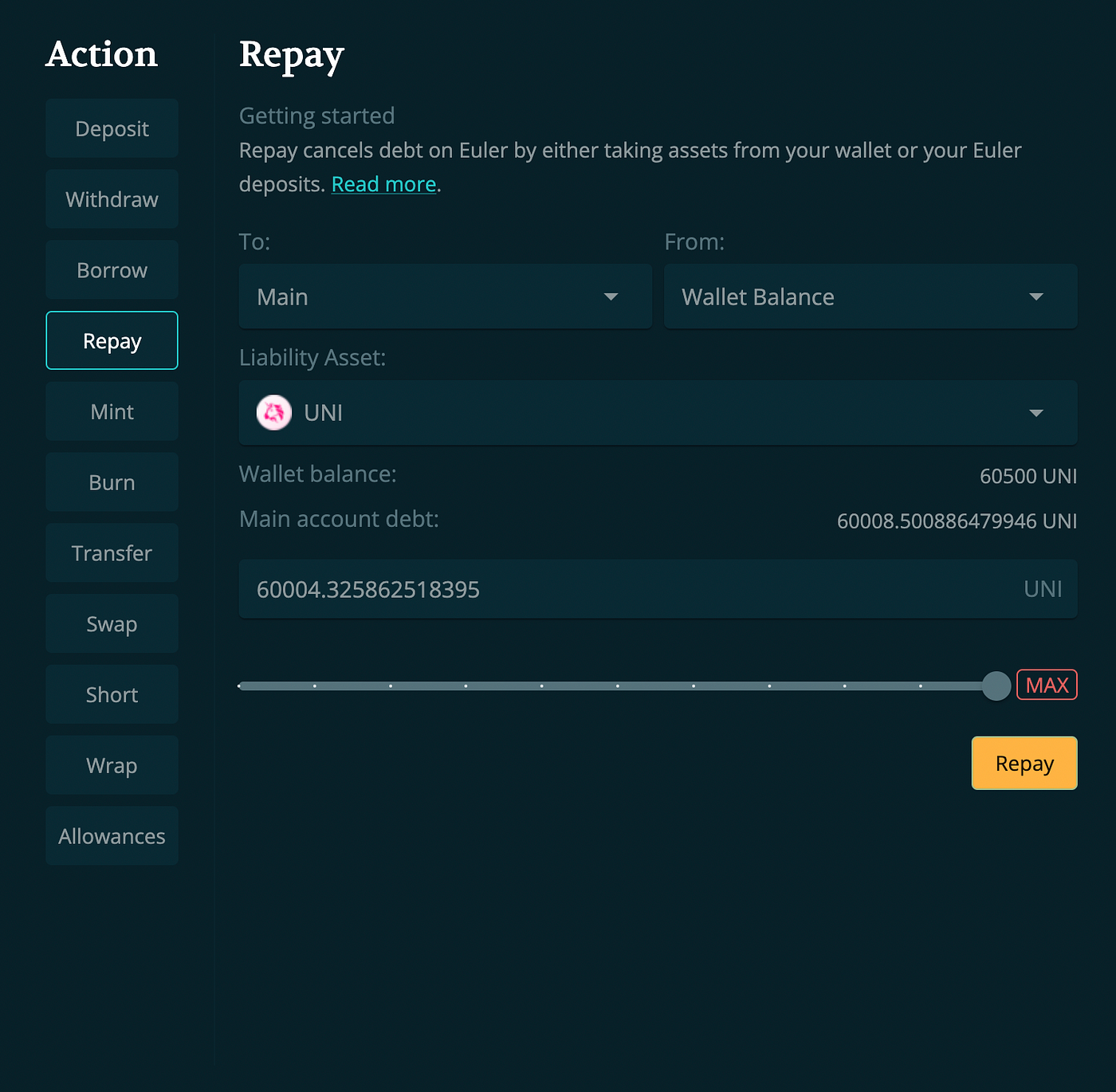

Select Repay in the Quick Action menu and choose the account with borrowed assets. If the user has the assets in their wallet, select Wallet Balance.

在快速操作菜单中选择"还款(Repay)",然后选择借入资产的账户。如果用户的钱包中有资产,请选择钱包余额。

If the user deposited the borrowed assets back into the Euler dApp, select Euler Deposits in the FROM menu. Users can also repay using a different asset here by selecting another asset which will swap and repay the debt.

如果用户将借来的资产存回 Euler dApp,请在 "从(FROM)" 菜单中选择 Euler Deposits。用户还可以在这里通过选择另一种资产来交换和偿还债务,从而使用不同的资产进行还款。

Then click on Enable and confirm the transaction just like before. Once completed, the user will be able to determine the amount of tokens to repay. Press Send in the Transaction Builder and confirm the transaction.

然后单击"激活(Enable)"并像以前一样确认交易。完成后,用户将确定要偿还的代币数量。在 “交易生成/构建器(Transaction Builder)” 中按"发送(Send)"并确认交易。

TIP: If there is a small amount of borrowed assets still in the account, these are debt from accrued interest. Users can pay it off using the Repay action and changing FROM Wallet Balance to Euler Deposits. Swaps are disabled on Testnet.

提示:如果账户中仍有少量借入资产,这些是应计利息的债务。用户可以使用 Repay 操作将其从 Wallet Balance 更改为 Euler Deposits 来还清。交换在测试网上被禁用。

提款 (Withdraw)

Users can withdraw their assets by going to the Quick Action menu and selecting Withdraw. Choose the account to use and asset to withdraw, along with the desired amount of tokens.

用户可以通过跳转到"快速操作(Quick Action)"菜单并选择"提款(Withdraw)"来提取他们的资产。选择要使用的账户和要提取的资产,以及所需的代币数量。

Click on the Withdraw button, Send txs in the Transaction Builder, and confirm the transaction. Tokens will return to the user’s wallet once the transaction is complete.

点击"提款(Withdraw)"按钮,在“交易生成/构建器(Transaction Builder)”中发送交易,并确认交易。交易完成后,代币将返回用户的钱包。

In the screenshot above, the total amount of deposited assets cannot be withdrawn because there are still assets being borrowed.

在上面的截图中,由于仍有资产被借入,所以无法提取全部存入资产。

TIP: If you receive a collateral violation preventing your withdraw, there might be debt assets left to be repaid.

提示:如果您收到阻止您提款的抵押品违规通知,则可能有债务资产需要偿还。

许可 (Allowances)

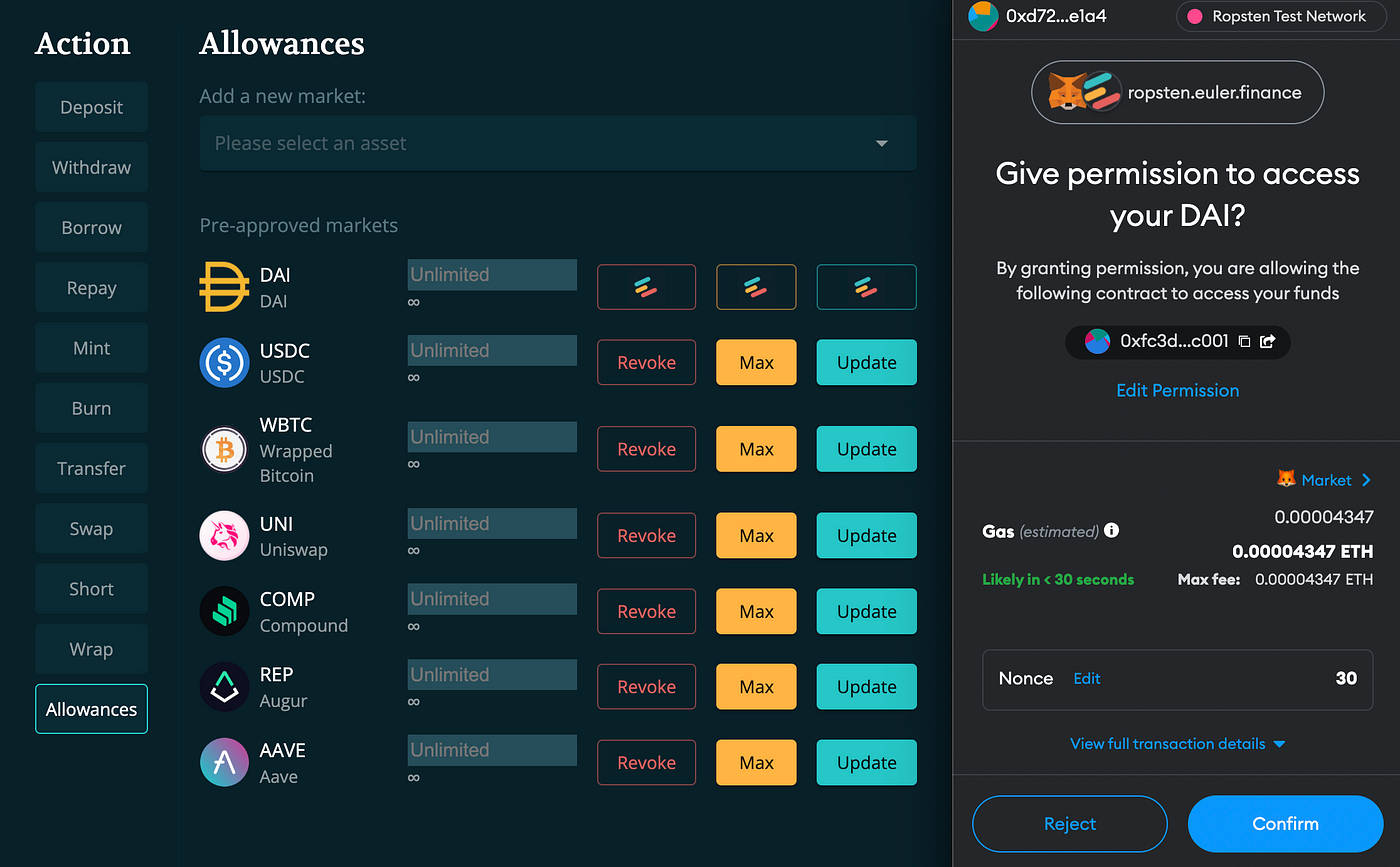

Users who have enable Euler to have access to their tokens can revoke that access by going to the Quick Action menu and selecting the Allowances tab. Users can see the pre-approved markets and change the number of tokens allowed or revoke access completely. Additionally, users can search for tokens to create a new allowance.

允许 Euler 访问其代币的用户,可以通过转到"快速操作(Quick Action)"菜单并选择 许可(Allowances) 选项卡来撤销该访问权限。用户可以查看预先批准的市场并更改许可的代币数量或完全撤销访问权限。此外,用户可以搜索代币来创建新的配额。

Clicking on Revoke, Max, or Update will start a transaction for the user to confirm.

单击 Revoke(撤销)、Max(最大) 或 Update(更新) 将启动一个交易以供用户确认。

Hopefully, this guide on borrowing and lending on the Euler dApp has helped users learn about the core features of the platform. In the next guide, users can learn more about advanced functions such as mint, burn, transfer and more.

希望本借贷指南能够帮助用户了解该平台的核心功能。在下一个指南中,用户可以了解更多有关铸币、燃烧、转移等高级功能的信息。

Also note that this page will be updated to reflect changes on the Euler UI, so feel free to check back whenever new updates take place.

另请注意,此页面将更新以反映 Euler UI 上的更改,因此请随时在有新更新时回来查看。

If you have any questions, join us in Discord and feel free to ask the team. Please make sure to browse other guides in the main collection as well.

如果您有任何问题,请加入我们的 Discord 并随时向团队提问。请务必同时浏览主收系列的其他指南。

关于Euler (About Euler)

Euler is a capital-efficient permissionless lending protocol that helps users to earn interest on their crypto assets or hedge against volatile markets without the need for a trusted third-party. Euler features a number of innovations not seen before in DeFi, including permissionless lending markets, reactive interest rates, protected collateral, MEV-resistant liquidations, multi-collateral stability pools, sub-accounts, risk-adjusted loans and much more. For more information, visit euler.finance.

Euler 是一种资本效率高的无许可借贷协议,可帮助用户从其加密资产中赚取利息或对冲波动的市场,而无需受信第三方。 Euler 具有许多在 DeFi 中前所未有的创新,包括无许可的借贷市场、回应性利率、受保护的抵押品、抗 MEV 清算、多抵押品稳定池、子账户、风险调整贷款等等。有关更多信息,请访问 euler.finance。

加入社区 (Join the Community)

Follow us Twitter. Join our Discord. Keep in touch on Telegram (community, announcements). Check out our website. Connect with us on LinkedIn.

关注我们 Twitter。加入我们的 Discord。在 Telegram 上保持联系(community、announcements)。查看我们的网站。在 LinkedIn 上与我们联系。