Orderly:基于 NEAR 构建的订单簿交换协议 (Orderly: An Orderbook Exchange Protocol built on NEAR)

Orderly is a permissionless, decentralized exchange protocol and modular ecosystem built on top of NEAR. It uses an on-chain order book to provide a platform complete with a risk engine, matching engine, and shared asset pools for dApps to build on top of. dApps built on the Orderly will allow for financial instruments such as:

Orderly 是一个建立在 NEAR 之上的无许可化、去中心化的交换协议及模块化的生态系统。它使用链上订单簿,为在其上构建的dapp提供一个完整的平台,它包含风险引擎、匹配引擎和共享资产池。基于 Orderly 构建的 dApp 将使得下列金融功能落地:

- Spot Trading

现货交易 - Margin Trading

保证金交易 - Perpetual Swaps

永续合约 - Lending and Borrowing

借贷

Orderly aims to provide the most robust liquidity layer infrastructure for any dApp to utilize and build on. With the help of our incubators WOO Network and NEAR, we are able to leverage the knowledge and experience from both teams in order to achieve this vision.

Orderly 立志为任何 dApp 的使用和构建提供最强大流动性层的基础设施。在我们的孵化器 WOO Network 和 NEAR 的帮助下,我们能够利用两个团队的知识和经验来实现这一愿景。

There are more and more professional traders and market makers entering the DeFi space. AMMs are designed for retail traders and often don’t facilitate a more sophisticated trading strategy. Orderbook style DEXs are in high demand, however — very few of them are currently able to provide the trading experience required. Many fall short on liquidity, speed of transactions and cost of trading.

越来越多的专业交易员和做市商进入 DeFi 领域。 AMM 是为零售交易者设计的,通常不利于更复杂的交易策略。然而,订单簿式 DEX 的需求却极大——目前只有极少数能提供所需的交易体验。许多交易所因缺乏流动性、交易速度和交易成本等问题而倒闭。

Orderly will offer CeFi level trading infrastructure by leveraging WOO Network’s experiences in building trading platforms and decentralized exchanges. Bootstrapping liquidity has always been a key challenge for any orderbook DEX which is why we are glad to have the support of market makers such as Kronos Research for liquidity from the very beginning. Kronos Research is one of the leading market makers in the crypto space and will be able to support our offering of deep liquidity.

Orderly 将利用 WOO Network 在构建交易平台和去中心化交易所方面的经验,提供 CeFi(中心化金融) 级别的交易基础设施。引导流动性一直是任何订单簿类 DEX 的关键挑战,这就是为什么我们很高兴从一开始就得到 Kronos Research 等做市商的支持,来提供流动性。 Kronos Research 是加密领域的领先做市商之一,将能够支持我们提供深度流动性。

To further enhance liquidity, Orderly will launch community lending pools where token holders are able to lend assets to market makers while enjoying single-sided liquidity provision with sustainable yields.

为了进一步提高流动性,Orderly 将推出社区借贷池,代币持有者可以将资产借给做市商,同时提供单边流动性来享受可持续收益。

当前的问题和解决方案 (Current Issues and Solutions)

While the on-chain trading experience has improved drastically in the last couple of years, there are still some pretty obvious issues:

尽管在过去几年中链上交易体验有了显着改善,但仍然存在一些非常明显的问题:

-

DEX trading has high gas fees, commissions, and slippage

-

Pro traders rarely trade on defi — they require fast and liquid markets

-

There aren’t any whitelabeling solutions for derivative DEXs

-

DEX 交易有高昂的gas费、佣金和滑点

-

专业交易者很少在 defi 上进行交易——他们需要快速且流动性强的市场

-

衍生品 DEX 没有任何白标解决方案

Here are some of the solutions Orderly Network will offer:

以下是 Orderly Network 将提供的一些解决方案:

-

Orderly will be integrated with bridges that will allow for smooth deposits/withdrawals from any ‘layer one’ blockchain.

-

Thanks to the combination of orderbook efficiency and on-chain settlement, Orderly will offer market-leading execution with low latency and minimal fees.

-

Orderly will launch with immediate access to deep liquidity thanks to some of the largest market makers in the space.

-

Orderly 将与允许从任何“layer 1”区块链顺利存款/取款的跨链桥集成。

-

由于高效订单簿和链上结算的结合,Orderly 将以低延迟和最低费用提供市场领先的执行。

-

有本领域一些最大的做市商的帮助,Orderly上线就将立即获得深度流动性的支持。

关键特征 (Key Features)

There are many added features Orderly provides in comparison to Centralized exchanges and on-chain derivatives exchanges. Our infrastructure will provide:

与中心化交易所和链上衍生品交易所相比,Orderly 提供了许多附加功能。我们的基础设施将提供:

-

Highest throughput + lowest latency in DeFi

-

Low fees and tight spreads

-

Access to deep, aggregated liquidity from DeFi and CeFi platforms

-

Composability

-

Platform-wide community pool

-

最快的交易吞吐量+DeFi最低的延迟

-

低费用和低价差

-

深度整合的DeFi和CeFi流动性平台入口

-

可组合性

-

平台级别的社区(流动性)池

它如何工作 (How Does it Work?)

Orderly uses an on-chain order book built for composability. This provides a platform for modular dApps to utilize and build on. Professional market-makers ensure ample liquidity for the network at all times

Orderly 使用为可灵活组合而构建的链上订单簿。这为模块化 dApp 提供了一个可以利用和构建的平台。专业做市商始终确保网络充足的流动性。

为什么选择Near (Why NEAR?)

NEAR is currently one of the most scalable, fast and user-friendly layer one blockchains in space. This sort of technology is a preferred and an ideal match for supporting an order book trading platform.

NEAR 目前是行业中最具扩展性、快速和用户友好的layer1区块链之一。这种技术是支持订单簿交易平台的首选和理想匹配。

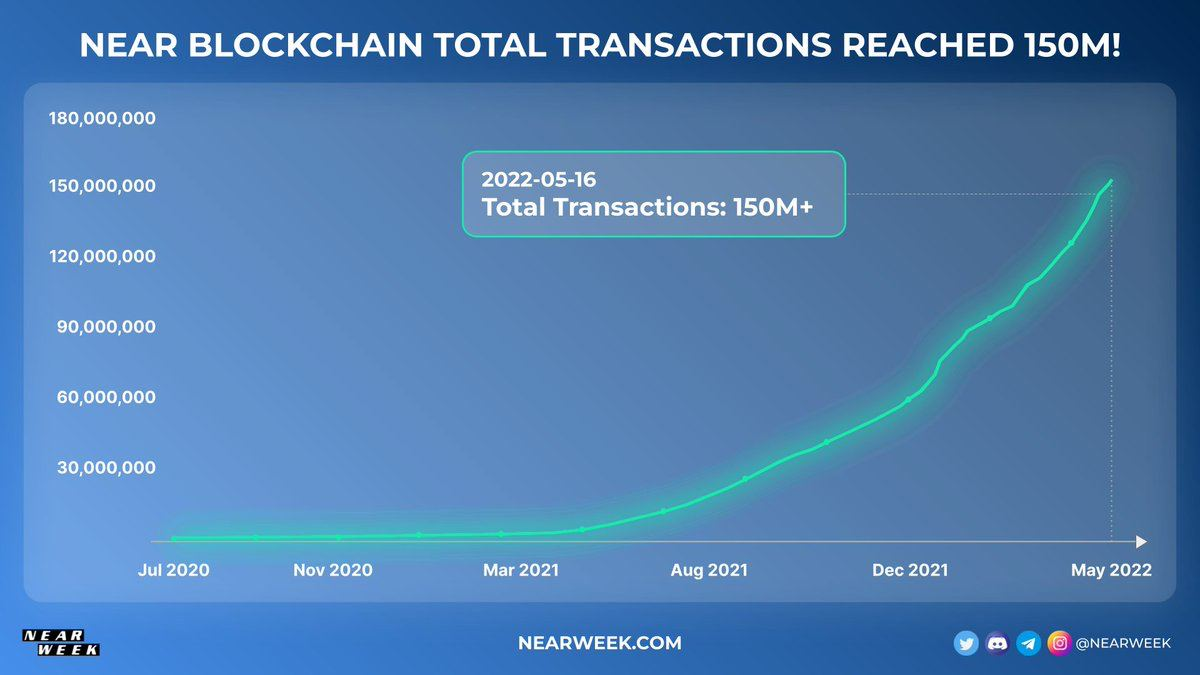

NEAR is one of the faster growing layer one blockchains. As you can see below, the chain has skyrocketed with the number of total transactions. They have also just crossed 12 million active wallets!

NEAR 是增长较快的layer1区块链之一。正如您在下面看到的,该链随着总交易量的增加而飙升。它们刚刚还超过有1200万个活跃钱包!

On top of users, it’s also increasingly gaining traction with developers. Part of this is because NEAR is Rust compatible, one of the reasons Solana has attracted its developer base. On top of that, the network is incredibly cheap. This is a prerequisite for any sort of on-chain derivatives platform.

除了用户之外,它也越来越受到开发人员的关注。部分原因是 NEAR 与 Rust 兼容,这也是 Solana 吸引其开发人员基础的原因之一。最重要的是,Near网络非常便宜。这是任何类型的链上衍生品平台的先决条件。

NEAR x WOO

WOO Network and NEAR can help push DEX spot and derivatives markets by combining centralized orderbook efficiency with on-chain settlement. The Orderly Network will offer market-leading order execution with low latency and minimal fees at scale.

WOO Network 和 NEAR 可以通过将集中式订单簿效率与链上结算相结合,帮助推动 DEX 现货和衍生品市场。 Orderly Network 将以低延迟和最低费用大规模提供市场领先的订单执行。

On-chain perpetuals are quickly growing in the crypto space. However, it is still in its nascent stages compared to more well established, centralized financial platforms. As seen in the graph above, there has already proven to be a multitude of successful platforms in this sub-sector of DeFi. There have been a number of large firms who have looked to build trading platforms on Solana, utilizing protocols like Project Serum. There are specific reasons developers, traders, and investors were interested in that. A lot of those same specifics port over to building on the NEAR blockchain, including Rust compatibility, speed, low latency, and low transaction cost.

链上永续合约在加密领域迅速增长。然而,与更完善的中心化金融平台相比,它仍处于起步阶段。如上图所示,在 DeFi 的这个子领域中有许多已经证明成功的平台。已经有许多大公司希望在 Solana 上建立交易平台,使用像 Project Serum 这样的协议。开发商、交易员和投资者对此感兴趣是有具体原因的。许多相同的细节都移植到了 NEAR 区块链上,包括 Rust 兼容、速度、低延迟和低交易成本。

For the reasons stated above, NEAR will be a great host (in regards to layer ones) for this sort of platform. Along with a central order book model, and the deep liquidity from professional market makers, Orderly should provide a superb experience for on-chain trading.

由于上述原因,NEAR 将成为此类平台的出色主机(就layer1而言)。加上中央订单簿模型,以及来自专业做市商的深度流动性,Orderly会为链上交易提供卓越的体验。

路线图 (Roadmap)

-

2022Q1:Close strategic round

-

2022Q2:Tesetnet Launch;Spot trading(testnet);Website soft launch;WOO DEX

-

2022Q3:Mainnet launch;Community pool;Additional MMs onboarding;Additional projects to build dApps on Orderly

-

2022Q4:Perpetual futures trading;Phase 2 of decentralization;5+ DEXs built on Orderly

-

2022Q1:结束战略论融资

-

2022Q2:测试网上线;现货交易(测试网);网站软启动;WOO DEX

-

2022Q3:主网上线;社区池;新做市商加入;在Orderly上构建的其他项目加入

-

2022Q4:永续合约交易;去中心化第二阶段;超过5家DEX在Orderly上构建

If you’d like information on Orderly Network , be sure to follow our social media accounts here!

如果您想了解有关 Orderly Network 的信息,请务必在此处关注我们的社交媒体帐号!

Discord: discord.gg/OrderlyNetwork

Twitter: @OrderlyNetwork