版权声明(Copyright Notice)

本文翻译自sommfinance的文章:SOMMELIER: WELCOME TO THE NEW COPROCESSOR FOR ETHEREUM。已得到作者的授权。译者为@chainguys。转载请注明作者和译者。

(Coptyright©2021 by sommfinance, translated by @chainguys)

本翻译文章所展示的一切信息都只是为了学习和交流目的,不能也不应成为任何财务或投资建议。

(All content shown are for communication and learning purposes, cannot and should not be viewed as any form of Financial or Investment Advice)

1. Hello World

Sommelier is a bet that Ethereum will be a dominant player in the global economy. It’s a bet that not only will Ethereum work, but that the growing architecture evolving in both L1 and L2 ecosystems continues to merge. To unlock its full potential, Ethereum needs a new coprocessor. This new computational machine will ensure that small investors maintain democratic access to Ethereum transactions with expanded functionality and opportunities to profit while minimizing their gas costs. The Ethereum network is the place to put capital to work and Sommelier is the partner to make that happen. Sommelier solves a number of key problems for the individual user on Etherum’s world computer network that we’ll outline below and that will serve as the thesis for our new coprocessor design and implementation.

Sommelier坚信以太坊将会在全球经济中占据支配地位。以太坊不但(本身)有用,而且还会带来一个L1和L2生态系统不断涌现的,自身也不断成长的(技术)架构。要完全发挥它的潜力,以太坊就需要一个新的协处理器。这个新的计算机器(computational machine)将确保小型投资者也能利用(以太坊)不断扩张的功能和机遇,民主地、低成本地参与到以太坊生态的交易中并盈利。以太坊的主网将会是注入资金的地方,而Sommelier则会作为以太坊的伙伴来帮助完成这个目标。在下面的文章中我们将详细阐述我们如何设计和行动来帮助用户在解决在以太坊这一世界级网络系统中会遇到的难题。

From translator @chainguys:

A coprocessor is a computer processor used to supplement the functions of the primary processor (the CPU).For more details, please kindly see Wikipedia:Coprocessor

辅助处理器(英语:Coprocessor),也译作协处理器,这是一种协助中央处理器完成其无法执行或执行效率、效果低下的处理工作而开发和应用的处理器。更多信息请查看维基百科。

2. 不活跃的线上流动性(INACTIVE ONCHAIN LIQUIDITY)

By design, Ethereum’s on-chain liquidity, with over 37 billion+ dollars, locked by on-chain programs, are user-push and non-proactive in the protocol, if not most blockchains. By default, it is safer for protocol designers to disallow protocol-level work scheduling capabilities that can execute business logic automatically due to the danger and risk of runaway processes that may put an entire protocol and its token value at risk.

The need for such controls ensure that value is protected from unintended consequences of protocol-level transaction automation. However, this restriction penalizes the movement of on-chain liquidity in un-attended ways. Limited onchain liquidity automation requires the constant monitoring and active management of push transactions from all users on the protocol.

以太坊锁在链上程序的,价值超过370亿美金的(线上)流动性,其实需要用户来操作(user-push),在(各类AMM)协议中也并不活跃,别的链就更不用说了。而这样(不活跃),会被默认更加安全,因为协议的设计设者们不会在协议的宏观层面允许一个可以自动执行的商业逻辑,尤其是当有危险时自动“跑路”,这回对整个协议和代币系统造成(系统性)风险。所以,控制这些(自动化)的需求确保了价值不被协议层面的交易自动化可能带来的不可预知后果所伤害。但是,这样的限制也损害了线上流动性(参与/活跃)的可能性。要限制线上流动性的自动化,就需要对协议的所有交易和用户进行长期跟踪和主动管理。

We see evidence of this by the rise of various Ethereum, onchain liquidity automation solutions that are already proposed to help solve these problems. However, these solutions themselves are also built on Ethereum and are constrained by the same architectural design limitations of the core protocol. They are only able to complete transactions discreetly and cannot continue with infinite automation. They either are only able to conduct local, specific automation or they must themselves stop their transactions and be manually restarted.

It is our view that Ethereum’s potential will be unleashed with the addition of active onchain liquidity via the Sommelier protocol. The protocol aims to drive more inactive on-chain liquidity to become continuously active. It’s our belief that these new functionality will drive more Ethereum transaction volume and value for the network.

我们也从这些地方看到了证据:大量(准备)将以太坊在线流动性进行自动化操作的项目和方案不断涌现。然而,这些方案本身也是在以太坊上开发的,所以也受制于由核心协议引出的架构设计问题。他们只能够蹑手蹑脚地完成转账,也不能永续自动化。他们要么只能在本地完成特定的自动化,要么就只能转账停止之后再手动重启。我们认为,以太坊的潜力在通过Sommelier带来的活跃线上流动性之后才能被充分发挥。Sommelier旨在让“沉寂”的线上流动性变得长期活跃。我们坚信Sommelier会让以太坊的交易规模和价值不断增加。

3. 消极线上流动性和高gas损害以太坊的小型DEFI投资者(PASSIVE ONCHAIN LIQUIDITY AND HIGH GAS COSTS HURT SMALLER ETHEREUM DEFI INVESTORS)

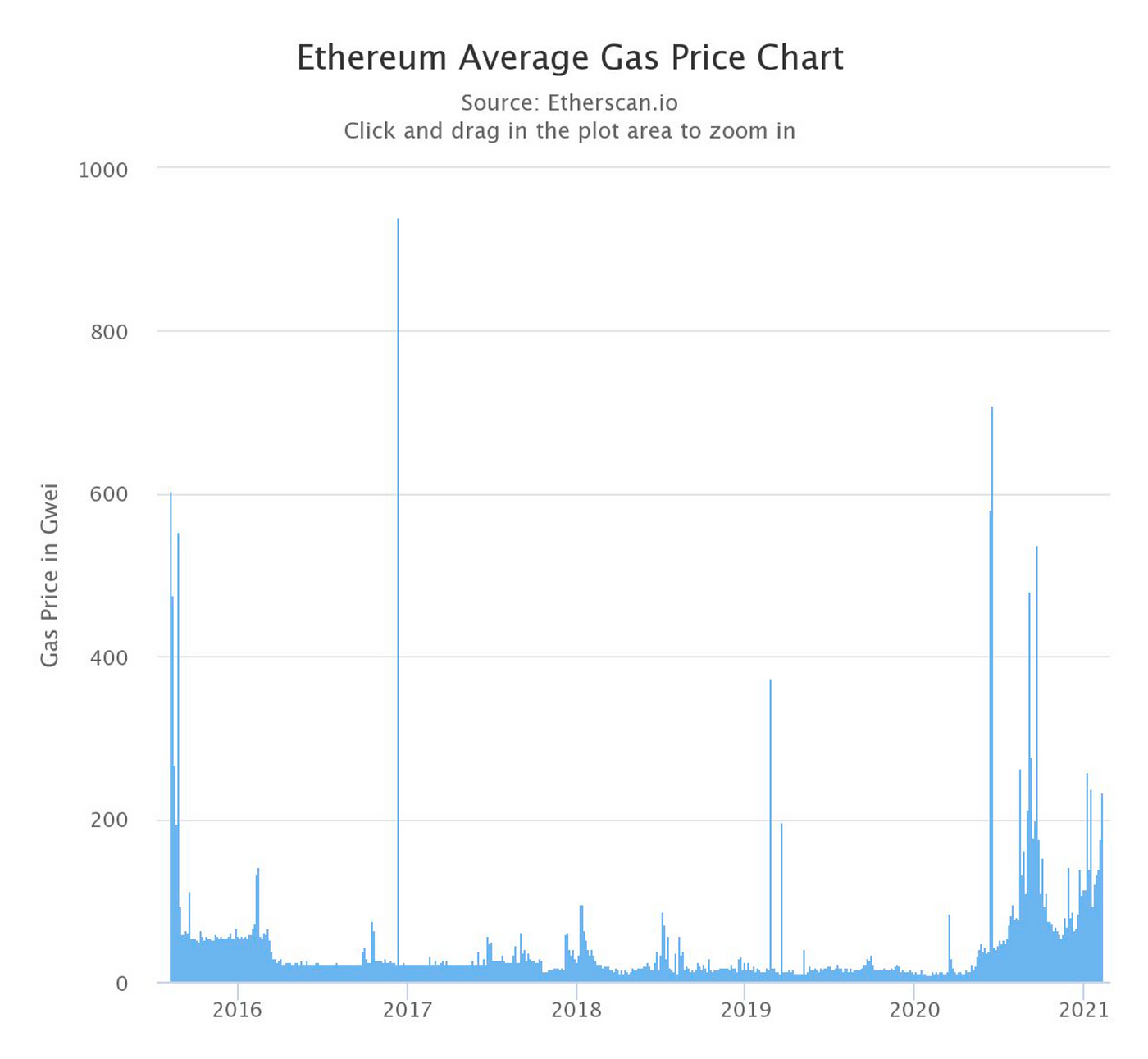

If you are a large institutional investor conducting a trade through an Ethereum DeFi AMMs, gas fees and infrastructure costs are not a problem. Your transaction gas fee of $100USD is nothing when your transaction is $1,000,000 or more. Additionally, large investors are able to build their own trading infrastructure and DeFi tools to ensure that they are able to maintain a high velocity for their liquidity. This advantage is not a possibility for smaller investors who have to make decisions on which liquidity opportunities they should choose across an ever expanding universe of options. As of this writing, the Ethereum Average Gas Price is at a current level of 232.62 gwei, up from 12.41 gwei one year ago.

如果你是一个在以太坊DeFi AMM交易的大型机构投资者,gas和基础设施等费用对你来说就不是个问题。一百美金的转账费用对于一百万美金的转账金额来说无非九牛一毛。除此之外,大型投资者也可以建设自己的基础设施和DeFi(交易)工具来确保流动性的高周转率。这样的优势对于还要在不断增加的选项中判别流动性机会的小型投资者来说是根本不可能的。在写作此文的时候,以太坊的平均gas价格达到了232.52 gwei,而一年之前只有12.41 gwei。

来源: Etherscan.io

Rising gas prices means that smaller investors are unable to actively participate in many Ethereum DeFi opportunities. Their window of selections will continue to decrease as gas prices increase. Additionally, the rising price of Ethereum means that smaller investors outside the Ethereum ecosystem will be priced out before they can participate. New opportunities for L1 batching and L2 roll-ups mean that solutions are coming, but the smaller investor just wants the lowest cost route to participate in the Ethereum DeFi ecosystem and through a wallet that she understands. She cannot be forced to choose and make the lowest cost decision from a myriad of choices. She desperately needs a fast way to access the lowest cost transaction network possible.

高企的Gas意味着小型投资者无法有效积极地参与和捕捉Defi的机会。而他们选择的窗口也会随着gas增长越变越小。不仅如此,不断增长的以太坊价格也意味着在以太坊生态之外的小型投资者在他们能够参与(以太坊)之前就被赶出来(price out)。在L1和L2的机会不断涌现,意味着解决方案正在涌现,不过小型投资者想要的是用一个他们熟悉的钱包和最低的成本路径来参与以太坊的DeFi生态。小型投资者无法从过量的信息中做出一个成本最低的决定。小型投资者需要一个接入低成本交易网络的入口。

Sommelier’s L1 batching capabilities and L2 participation in the coming roll-up offerings means that smaller investors have a partner to maintain their position as active participants in DeFi. With Sommelier, smaller-investor liquidity gets the same momentum as the bigger institutional players and they are able to continue to participate in the Ethereum DeFi ecosystem.

Sommelier在将来roll-up的L1和L2中将会提供方法来让小型投资者尽可能成为和保持DeFi积极参与者的角色。小型投资者可以使用Sommelier来让自己流动性的动量(momentum)也能和大机构并驾齐驱,并且长期参与以太坊DeFi生态。

4. 以太坊的签名设计限制了DeFi用户间交互的范围(ETHEREUM SIGNATURES DESIGN LIMIT THE SCOPE OF DEFI USER ETHEREUM INTERACTIONS)

Signature creation and broadcast requires that Ethereum DeFi users must monitor their wallets to manage their portfolio risk. DeFi users without substantial information infrastructure cannot expand their trading volume and are limited in their transaction volume. Automated transactions managed by Sommelier’s validators give Ethereum DeFi users more interactions and more opportunities to capture profits across complex compositions.

制造和广播签名要求以太坊的DeFi用户必须时时监控他们的账户来进行风险管理。DeFi用户如果没有充分的信息基础设施是无法扩大交易规模的,甚至连转账规模也会受限。由Sommelier的验证节点管理的自动转账系统会基于DeFi用户更多的交互和更多复杂组合间捕捉利润的机会。

5. 我们离“民主金融”还有一段长路(WE STILL HAVE A LONG WAY TO GO TO DEMOCRATIZE FINANCE)

As of this writing, we are very proud that the Ethereum ecosystem has successfully locked up over $39 Billion of value on-chain. However, we think this is still the early adopter phase of DeFi. Although we have lowered the barriers of decentralized finance and provided access to many, new financial products and communities, there is still a large, global population of individuals who need to participate in the Ethereum economy. The Ethereum Virtual Machine needs additional features from the new Sommelier coprocessor to support low-cost access for the rest of the world willing and eager to participate in this ecosystem. Without these additional features, barriers to participation such as high gas costs and expensive infrastructure will keep many users on the sidelines. Sommelier wants to be a new and tangible step to bringing further the promise of financial democracy and freedom on the Ethereum blockchain. Sommelier will make it so that these issues are no longer relevant in the Ethereum Virtual Machine.

此文写作之时,我们对以太坊生态上有超过390亿的链上资产感到非常自豪。然而,我们认为这仍然是DeFi的早期。尽管我们已经降低了去中心化金融的门槛,给很多金融产品和社区提供了入口,但世界上仍然有大量的人口需要参与到以太坊的经济中。以太坊虚拟机(EVM)需要Sommelier这个辅助处理器提供的新功能来让世界其他愿意参与以太坊生态的人以低成本来加入。如果没有这些新的功能,那么高gas和昂贵的基础设施等问题就会让许多人无法参与。Sommelier希望成为以太坊上带来金融民主和自由的关键一步。Sommelier也会继续努力来解决EVM上存在的问题。

6. 结论(CONCLUSION)

Sommelier aims to be a new coprocessor to expand the scale and scope of Ethereum DeFi transactions for all users on the Ethereum network. The Sommelier team’s position is that Etherum will be the dominant player in the decentralized finance economy. However, the missing tooling for low-cost, and scalable liquidity management creates a risk that smaller investors will be unable to practically participate in this new economy. The ability to make fast and proactive liquidity decisions is the key of success for large institutional investors that are able to move their value where it can deliver the highest returns.

Sommelier aims to extend Ethereum functionality with its new coprocessor and intelligence in handling Ethereum transactions in ways that ensure that Ethereum remains useful (or accessible for all users). Sommelier allows for Ethereum users to enjoy the finest selection of liquidity transaction features. Join us as we continue to build on the liquidity narrative for Ethereum.

Sommelier立志成为所有以太用户扩大以太坊Defi的规模和领域。Sommelier团队坚信以太坊将会在去中心化经济中占据支配地位。然而,缺少一个低成本、可扩展的流动性管理工具,会使得小型投资者有无法参与的风险。快速和主动的流动性决策能力是大型机构投资者成功地关键,因为这使得他们可以将资金投入到回报跟高的地方。

Sommelier致力于用新的辅助处理器和情报,以确保以太坊可用性的方式来管理以太坊的交易,从而扩展以太坊的功能(使得它可以被所有人使用)。Sommelier使得以太坊用户可以享受到最好的流动性交易选择。我们会一直为以太坊的流动性和工作,快来加入我们吧!