版权声明(Copyright Notice)

本文翻译自Kento Inami 为UXD项目的白皮书,并已得到授权。译者为@chainguys。转载请注明作者和译者。

(Coptyright©2021 by Kento Inami from UXD , translated by @chainguys)

本文所展示的一切信息都只是为了学习和交流目的,不能也不应成为任何财务或投资建议。

(All content shown are for communication and learning purposes, cannot and should not be viewed as any form of Financial or Investment Advice)

概述 (Abstract)

An algorithmic stablecoin 100% backed by a delta neutral position using perpetual swaps will enable individuals and organizations to exchange value in a familiar accounting unit without the need to interact with the banking system.

100%使用永续合约的delta中性头寸支持的算法稳定币,将使个人和组织能够在熟悉的会计单位中交换价值,而无需与银行系统交互。

The stablecoin is pegged to fiat currencies by connecting to a derivatives dex. Users earn interest generated from the funding rate. Arbitrage ensures that the price of the stablecoins does not deviate from the price of fiat currencies. Any user will be able to issue and redeem the stablecoins for a decentralized cryptocurrency at par value.

稳定币通过连接衍生品的去中心化交易所(dex)与法定货币挂钩。用户可以赚取资金费率产生的利息。套利确保稳定币的价格不会偏离法定货币的价格。任何用户都可以按去中心化加密货币面值发行和赎回稳定币。

Users can verify that the reserves equal the amount of stablecoins in circulation by checking the blockchain.

Since the collateral backing the stablecoin is not held by a centralized third party, the collateral is not at risk of being seized by a hostile third party.

用户可以通过检查区块链来验证储备是否等于流通中的稳定币数量。

由于支持稳定币的抵押品不是由中心化的第三方持有,因此抵押品没有被敌对第三方没收的风险。

The stablecoin will have the censorship resistant properties of cryptocurrency and the price stability of fiat currencies. The funding rate results in yield to the holders of the stablecoin, which makes the stablecoin an attractive store of value.

稳定币将具有加密货币的抗审查特性和法定货币的价格稳定性。资金费率为稳定币的持有者带来收益,这使得稳定币成为有吸引力的价值储存手段。

介绍 (Introduction)

There is a wide range of stablecoins circulating in the crypto ecosystem such as Tether, USD Coin, Paxos Standard, Dai, etc. But fiat backed stablecoins suffer from censorship and audit problems. Cryptocurrency backed stablecoins are capital inefficient and can be unstable during extreme market volatility. Algorithmic stablecoins are susceptible to a collapse in confidence by holders of the stablecoin, and are at risk of bank runs. UXD Protocol proposes to solve these problems by eliminating the need to convert to fiat currencies and to be stable under any market volatility. UXD Protocol is also more capital efficient than cryptocurrency backed alternatives, since UXD Protocol does not require an excess of funds to back the stablecoin.

加密生态中流通的稳定币种类众多:Tether、USD Coin、Paxos Standard、Dai 等。但法币支持的稳定币存在审查和审计问题。而加密货币支持的稳定币,资本效率低下,并且在极端市场波动期间可能不稳定。算法稳定币容易受到稳定币持有者信心崩溃的影响,并面临银行挤兑的风险。 UXD 协议建议通过以下方式来解决这些问题:消除转换为法定货币的需要,且设法在任何市场波动下保持稳定。(如此),UXD 协议也会比加密货币支持的替代方案更具资本效率,因为 UXD 协议不需要过多的资金来支持稳定币。

We will use bitcoin and USD in the following explanations but other cryptocurrencies and fiat can be substituted. The UXD Protocol will support multiple cryptocurrencies as collateral and other fiat stablecoins will be issued.

我们将在下面的解释中使用比特币和美元,但可以用其他加密货币和法定货币代替。 UXD 协议将支持多种加密货币作为抵押品,并发行(锚定)其他法币(非美元)的稳定币。

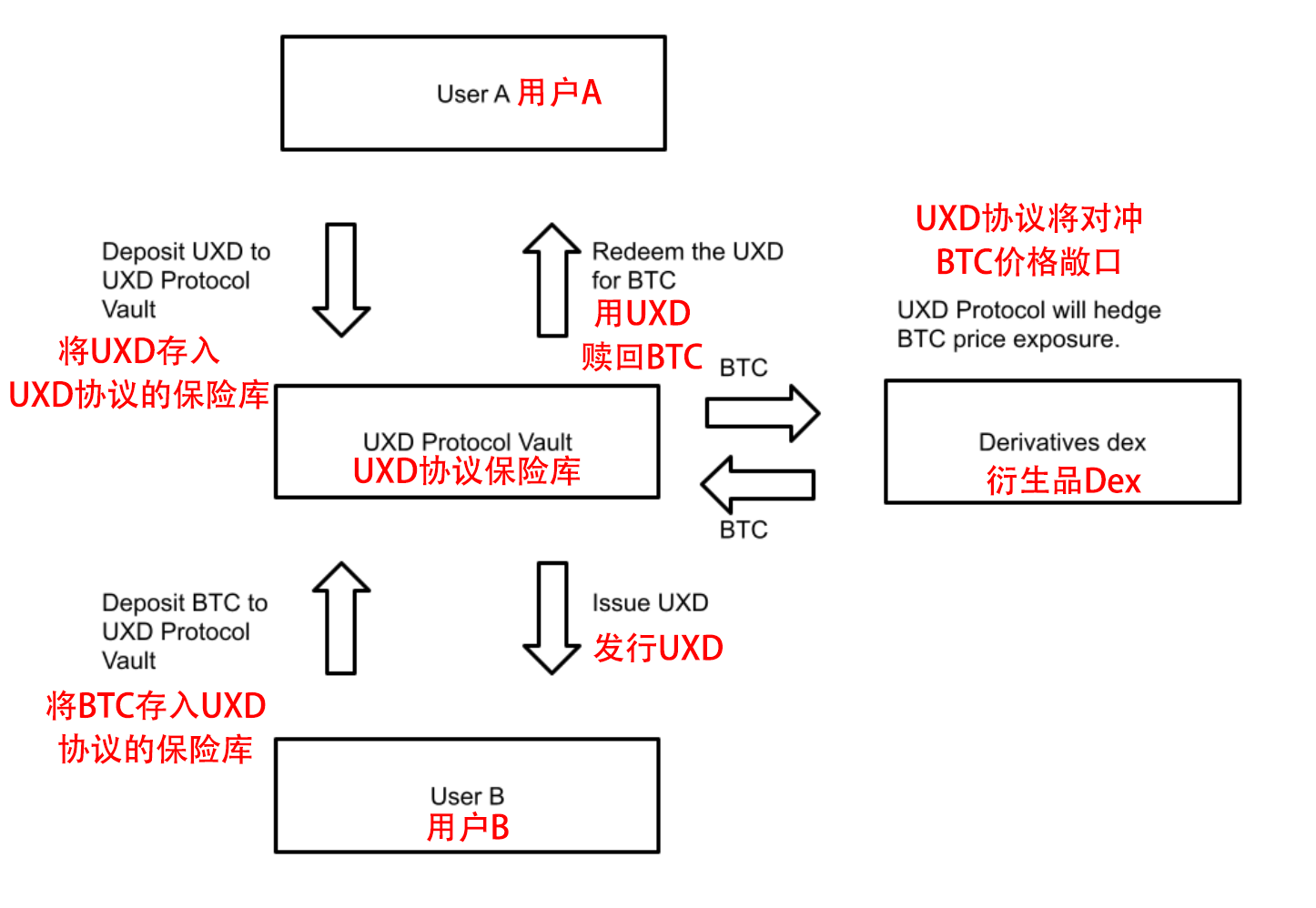

资金流程 (Flow of Funds)

第1步 (Step1)

The user deposits BTC worth 100 USD to the vault of UXD Protocol. (We will use an oracle to calculate the price of BTC.)

用户将价值 100 美元的 BTC 存入 UXD 协议的保险库。(我们将使用预言机来计算 BTC 的价格。)

第2步 (Step2)

UXD Protocol will mint 100 stablecoins (100 UXD). Total USD value of BTC deposited by the user = amount of UXD issued to the user.

UXD 协议将铸造 100 个稳定币(100 UXD)。用户存入的 BTC 总美元价值 = 发给用户的 UXD 数量。

第3步 (Step3)

Users can transact with UXD. The user can transfer, exchange, and store UXD.

用户可以使用 UXD 进行交易。用户可以转移、交换和存储 UXD。

第4步 (Step4)

UXD Protocol transfers the BTC to a derivative dex and creates a delta neutral position to hedge.

UXD 协议将 BTC 转移到衍生品的dex,并创建 delta 中性头寸来进行对冲。

第5步 (Step5)

The user deposits 100 UXD to the UXD Protocol vault for redemption into 100 USD worth of BTC.

用户将 100 UXD 存入 UXD 协议金库,来兑换成价值100美元的 BTC。

第6步 (Step6)

The delta neutral position is unwinded at the derivative dex and the BTC is withdrawn to the UXD Protocol vault.

Delta中性头寸在衍生品dex处平仓,BTC 被撤回到 UXD 协议保险库。

第7步 (Step7)

UXD Protocol will destroy the UXD and an equivalent amount of BTC will be withdrawn to the user’s wallet.

UXD 协议将销毁 UXD,并将等量的 BTC 提取到用户的钱包中。

Users will also be able to obtain UXD through centralized and decentralized exchanges, and other third party services. Once the UXD is in circulation, it is freely traded.

用户还将能够通过中心化和去中心化交易所以及其他第三方服务获得 UXD。一旦 UXD 流通,它就可以自由交易。

资金流程图 (Flow of Funds Diagram)

Delta中性头寸 (Neutral Position)

For UXD Protocol to always be able to issue/redeem UXD at par value, UXD Protocol will short BTC/USD perpetual swaps on a derivatives dex(decentralized exchange) to an equivalent amount of the UXD in circulation. As a result, the position will be delta neutral and UXD Protocol will be protected from price fluctuations of BTC.

为了使 UXD 协议始终能够以面值发行/赎回 UXD,UXD 协议将在衍生品dex上做空 BTC/USD 永续合约,使其与流通中的 UXD 等值。因此,该头寸将是 delta 中性的,且 UXD 协议将免受 BTC 价格波动的影响。

例子 (Example)

Let’s assume that BTC/USD is trading at $10,000.

假设 BTC/USD 的交易价格为 10,000 美元。

A user issues 10,000 UXD in exchange for 1 BTC.

用户用1BTC发行 10,000 UXD。

Then there is 10,000 UXD in circulation. UXD Protocol will then have a 1 BTC short position using the 1 BTC as collateral on a derivatives dex.

然后有 10,000 UXD 在流通。然后,UXD 协议将以1 BTC 作为抵押品,在衍生品 dex持有 1 BTC 空头头寸。

The position is delta neutral and the value of the position + collateral will always be worth $10,000 which can be seen from the simulations below.

该头寸是 delta 中性的,头寸 + 抵押品的价值将始终价值 10,000 美元,这可以从下面的模拟中看出。

If the price of BTC increases to $20,000, the value of the collateral increases from $10,000 to $20,000 and the PnL is $10,000. The PnL of the short position is 1 BTC*( $10,000-$20,000) = -$10,000. The total PnL is $0.

如果 BTC 的价格上涨到 20,000 美元,则抵押品的价值从 10,000 美元增加到 20,000 美元,盈亏为 10,000 美元。空头头寸的盈亏为 1 BTC*($10,000-$20,000) = -$10,000。总盈亏为 0 美元。

If the price of BTC decreases to $5,000, the value of the collateral decreases from $10,000 to $5,000 and the PnL is -$5,000. The PnL of the short position is 1 BTC*($10,000-$5,000) = $5,000. The total PnL is also $0.

如果 BTC 的价格降至 5,000 美元,则抵押品的价值从 10,000 美元降至 5,000 美元,盈亏为 -5,000 美元。空头头寸的盈亏为 1 BTC*($10,000-$5,000) = $5,000。总盈亏也为 0 美元。

利率支付 (Interest Payments)

Users of UXD will earn part of the interest generated from the funding rate when the funding rate is positive. By utilizing smart contracts, UXD holders' balance will increase by the amount of interest automatically.

When the funding rate is negative, the negative interest will be paid out from the insurance fund.

当资金费率为正时,UXD的用户将获得资金费率产生的部分利息。通过使用智能合约,UXD持有者的余额将自动增加利息金额。

当资金费率为负时,负利息将从保险基金中支付。

保险基金 (Insurance Fund)

The insurance fund is set up so that the holders of UXD will not have to pay interest when the funding rate is negative.

设立保险基金是为了让 UXD 的持有者在资金费率为负时无需支付利息。

Let’s define the USD value of the insurance fund as INSusd.

让我们将保险基金的美元价值定义为 INSusd。

Then,

然后,

if INSusd > 0, the negative funding rate can be paid out from the insurance fund.

如果 INSusd > 0,负资金费率可以从保险基金中支付。

if INSusd < 0, UXD protocol will do an auction of governance tokens(UXP) to the public and replenish the insurance fund until INSusd > 0.

如果 INSusd < 0,UXD 协议将向公众拍卖治理代币(UXP)并补充保险基金,直到 INSusd > 0。

Besides the auction of UXP, there will be a constant positive flow of funds to the insurance fund when the funding rate is positive, since part of the funding rate will go to the insurance fund.

除了 UXP 的拍卖,当资金费率为正时,将有持续的正向资金流入保险基金,因为部分资金费率将流向保险基金。

套利 (Arbitrage)

If the price of the stablecoins deviates from the price of fiat, arbitrageurs will step in to issue/redeem the stablecoins and make a risk free profit. This will peg the price of stablecoins.

如果稳定币的价格偏离法定价格,套利者将介入发行/赎回稳定币并获得无风险利润。这将与稳定币的价格挂钩。

示例 (Example)

Suppose that UXD/USD is trading at 0.99. Traders can buy UXD with USD and redeem UXD for 1 USD worth of bitcoin. This will net the trader 0.01 USD of profit.

If UXD/USD is trading at 1.01, the trader can issue UXD with bitcoin and sell the UXD for 1.01 USD. This will net the trader 0.01 USD of profit.

假设 UXD/USD 的交易价格为 0.99。交易者可以用美元购买 UXD,并将 UXD 兑换为价值 1 美元的比特币。这将使交易者净赚 0.01 美元。

This type of risk free transactions will be arbitraged very quickly and UXD will be pegged to the value of USD.

如果 UXD/USD 在 1.01 交易,交易者可以用比特币发行 UXD,然后以 1.01 美元的价格卖出 UXD。这将使交易者净赚 0.01 美元。

可验证 (Verifiable)

The amount of stablecoins in circulation and the amount of bitcoin backing the stablecoins can be verified by checking the blockchain.

流通中的稳定币数量和支持稳定币的比特币数量(储备)可以通过检查区块链来验证。

The following equation will always hold.

The USD value of bitcoin as collateral + The USD value of the delta neutral position = The total amount of UXD in circulation.

以下等式将始终成立。

比特币作为抵押品的美元价值 + delta 中性头寸的美元价值 = 流通中的 UXD 总量。

As a result, UXD holders will always be able to redeem their UXD for bitcoin.

因此,UXD 持有者将始终能够将其 UXD 兑换为比特币。

结论 (Conclusion)

UXD Protocol is an algorithmic stablecoin that has censorship resistance, price stability, and is capital efficient. Holders of UXD will receive interest from the funding rate, which makes UXD also an attractive store of value.

People who are excluded from the banking system will now be able to store and transact in a stable currency without censorship.

UXD 协议是一种算法稳定币,具有抗审查性、价格稳定性和资本效率。 UXD 的持有者将从资金费率中获得利息,这使得 UXD 也是一个很有吸引力的价值存储。

被排除在银行系统之外的人现在可以在没有审查的情况下,用稳定的货币进行存储和交易。