Euler Finance’s frontend has had a significant improvement to the health monitor! Thanks to the hard work of contributors, users can clearly understand the risk of other events while having no effect on a position. Given that this is a simulation (and has no effect on the user’s existing position), this will assist a significant refinement in risk management.

Euler金融前端的健康监测有了显着提升!由于贡献者的辛勤工作,用户可以在不影响仓位的情况下清楚地了解其他事件的风险。鉴于这是一个模拟(并且对用户的现有仓位没有影响),这将有助于大幅改进风险管理。

Thanks to this boost to the Health Monitor, Users can now have a much clearer idea of what conditions might be met in order for their accounts to be flagged for liquidation. In addition, projected earnings changes are still clearly visible to enable a risk / return analysis.

由于对健康监控起的这一提升,用户现在可以更清醒地了解可能满足哪些条件其帐户才会被标记为清算。此外,预测的收益变化仍然清晰可见,可以进行风险/回报分析。

Euler 的健康监视器 (Euler’s health monitor)

As it stands, users enjoy a health monitor that is linked to an existing position in the protocol. Be it their own or another's (using the account spy), getting information about their positions is straightforward and easy to understand. Key metrics like time to liquidation, health score, collateral and liabilities (as well as their risk adjusted values) have been front and centre of any user’s dashboard.

就目前而言,用户享用与协议中现有仓位相关联的健康监视器。无论是其自身还是其他人的(使用账户间谍),获取有关其仓位信息都是简单易懂的。清算时间、健康评分、抵押品和负债(及其风险调整值)等关键指标一直是任何用户仪表板的前沿和中心。

This has made fitting their risk profiles to their activities on the protocol straightforward. In continuing with this spirit, users will now be able to simulate the health of their account with just a few clicks.

这使得他们的风险概况明明白白地契合其在协议上的活动。本着这种精神,用户现在只需单击几下即可模拟其帐户的健康状况。

新功能:账户健康模拟 (New feature: Account Health Simulation)

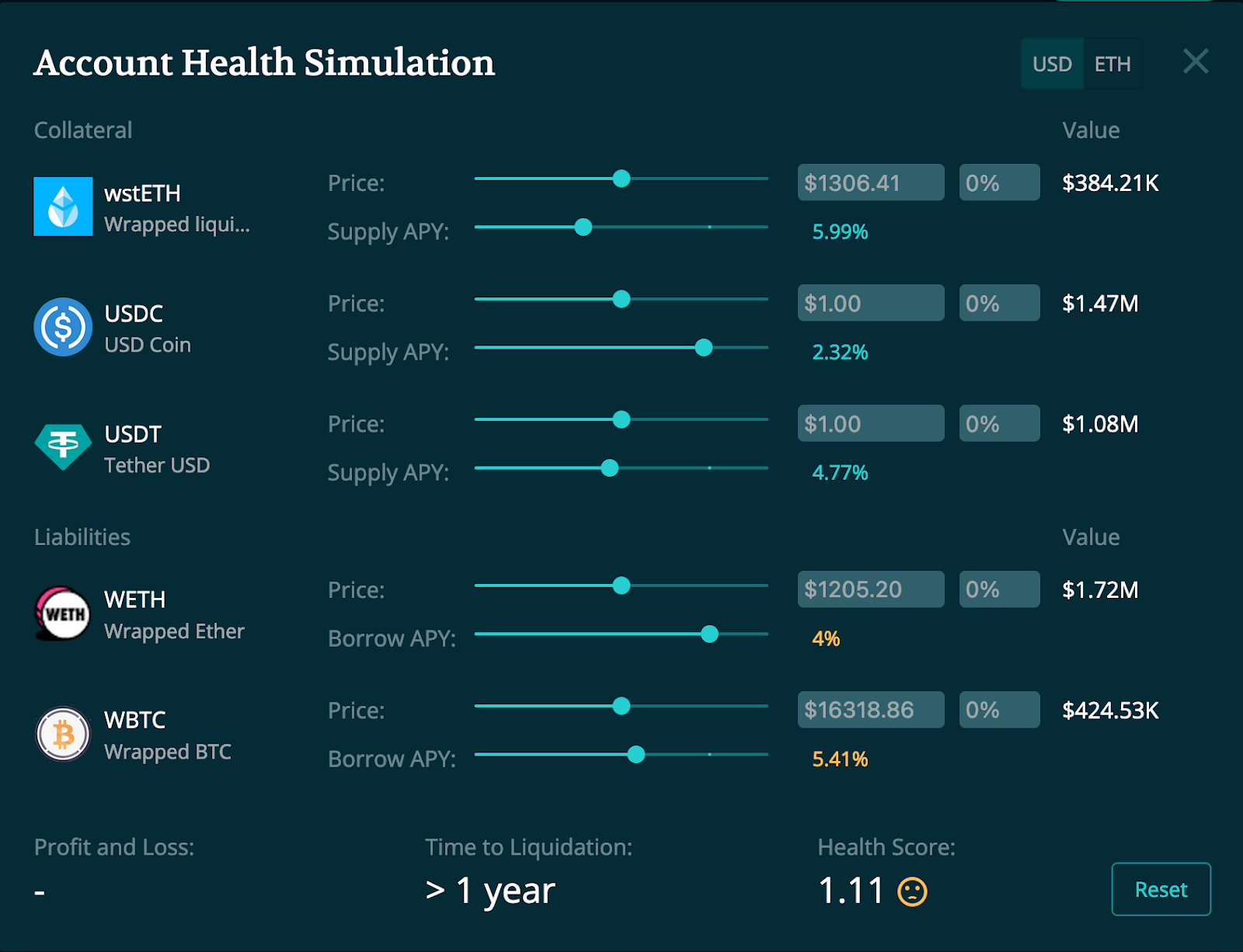

This new feature can be easily accessed by clicking on the “Simulate Account Health” button. Users will be met with a screen that overviews all of their assets and liabilities presented alongside sliders that can be modified alongside text boxes for more accurate and exact asset adjustments.

单击“模拟帐户健康”按钮,即可轻松访问此新功能。用户将看到一个屏幕,该屏幕概述了他们所有的资产和负债,以及可以与文本框一起修改的滑块,来进行更准确/精准的资产调整。

These sliders can change both the value of the assets and the cost of borrowing the asset in APY terms. By changing these two variables, users will see an estimate of the standing of their new position at the bottom of the dashboard.

这些滑块可以改变资产的价值和以 APY 计算的借入资产的成本。通过更改这两个变量,用户将在仪表板底部看到对其新仓位的估计。

In addition, this health simulator can be used in conjuction with batch transations. Users can batch multiple activities to set up a position they have in mind, and then use the tool to double check how that position is exposed to market movements. After that users can execute, modify further or cancel the transaction without paying any gas or changing any on-chain position.

此外,这个健康模拟器可以与批量交易结合使用。用户可以批处理多个活动,建立其心目中的仓位,然后使用该工具仔细检查该仓位如何受到市场变动的影响。之后,用户可以执行、进一步修改或取消交易,而无需支付任何 gas 或更改任何链上位置。

Remember: this is a simulation (and is separate entirely from the reality of the existing position). A significantly greater sense of risk management can come from this. It will be far easier to identify what changes have to occur in order to suffer liquidation. Furthermore, projected earnings deltas are front and centre to evaluate risk versus return.

请记住:这是一个模拟(并且完全独立于现有仓位的现实)。由此可以激发明显更强的风险管理意识。这比坐实一定会发生哪些变化才会遭受清算要容易得多。此外,预计收益增量是评估风险与回报的前沿和中心。

模拟变化:(Simulated change:)

To show the Account Health Simulation tool in action, let’s take the address used in the example above.

为了展示帐户健康模拟工具的运行情况,让我们以上面示例中使用的地址为例。

Say a user changes the value of WBTC to $24,000. Let’s also presume that given this increased WBTC price, those looking to short sell WBTC have driven up utilisation, increasing the cost of borrowing to almost 20%.

假设用户将 WBTC 的价值更改为 24,000 美元。再假设,鉴于 WBTC 价格上涨,那些希望卖空 WBTC 的人提高了利率,将借贷成本提高到近 20%。

Alongside this, our prospective user will simulate that with this appreciation of BTC, more users have rotated from ETH based assets and so the utilisation has decreased, thereby decreasing the lending APY earnings of wstETH (to 4.81%) and cost to borrow WETH (to 0.99%).

除此之外,我们的潜在用户将模拟,随着 BTC 的升值,更多用户从基于 ETH 的资产中转移,因此利率下降,从而降低 wstETH 的借贷 APY 收益(至 4.81%)和借入 WETH 的成本(至0.99%)。

Thanks to this new Account Health Simulation, new statistics relating to health under these conditions can easily be identified. The user is losing a substantial sum of money under these conditions, is close to liquidation should the value of BTC appreciate further / his collateral depreciate and if things remain as they are, he stands to be liquidated in around 300 days.

多亏了这个新的账户健康模拟,可以很容易地识别在这些条件下与健康相关的新统计数据。在这种情况下,用户将损失大量资金,如果 BTC 的价值进一步升值/他的抵押品贬值,他将接近清算,如果情况保持原样,他将在大约 300 天后被清算。

总结: (Roundup:)

Thanks to this new tool implemented onto Euler Finance’s frontend, users can more clearly visualise different conditions to help develop a comprehensive and robust risk profile. This tool builds on an already well-fleshed out suite of tools that users of Euler’s front-end currently enjoy.

由于在Euler金融的前端实施了这一新工具,用户可以更清楚地看到不同的情况,帮助制定全面而稳健的风险策略。该工具建立在 Euler 前端用户目前喜欢的一套已完善的工具之上。