原文:https://tokenterminal.substack.com/p/interview-with-michael-bentley-co?s=w

In this series, we interview core protocol contributors & together dive into the details behind the charts available on Token Terminal.

在本系列中,我们采访了核心协议d的贡献者,并一起深入了解 Token Terminal 图表背后的细节。

Below is a write-up of our discussion about the current state of Euler Finance with Co-Founder & CEO Michael Bentley (edited for clarity).

以下是我们与联合创始人兼首席执行官迈克尔·本特利 (Michael Bentley) 就 Euler 金融现状的讨论(为表达清晰,文本已经过编辑)。

This interview was recorded on May 5th. Some information has been updated to reflect the current state of Euler Finance.

这次采访发生于 5 月 5 日。一些信息已更新,进而反映 Euler金融的当前状态。

问:您能为那些还不熟悉的人快速介绍一下 Euler Finance 吗? (Q: Could you give a quick intro to Euler Finance for those not yet familiar?)

Euler is a DeFi lending and borrowing protocol on the Ethereum network. It allows users to deposit ERC20 tokens into the protocol and lend those out to borrowers. Like most other lending and borrowing protocols in DeFi, it’s overcollateralized lending. Borrowers that take assets out of the protocol have to put more value in as collateral before they can take assets out. The majority of lenders tend to be people seeking to earn passive income from their assets, while borrowers tend to be more active and advanced DeFi users. These advanced users are typically able to generate profits from their borrowing activities, of which they then pay a portion back to the lenders.

Euler 是以太坊上的 DeFi 借贷协议。它允许用户将 ERC20 代币存入协议并将其出借给借款人。与 DeFi 中的大多数其他借贷协议一样,它也是超额抵押的。将资产从协议中提出的借款人必须先将更多价值(的代币)作为抵押品,然后才能取出资产。大多数出借方往往是寻求从资产中获得被动收入的人,而借款人往往是更积极和先进的 DeFi 用户。这些高级用户通常能够从他们的借贷活动中获得利润,然后他们将其中的一部分偿还给出借方。

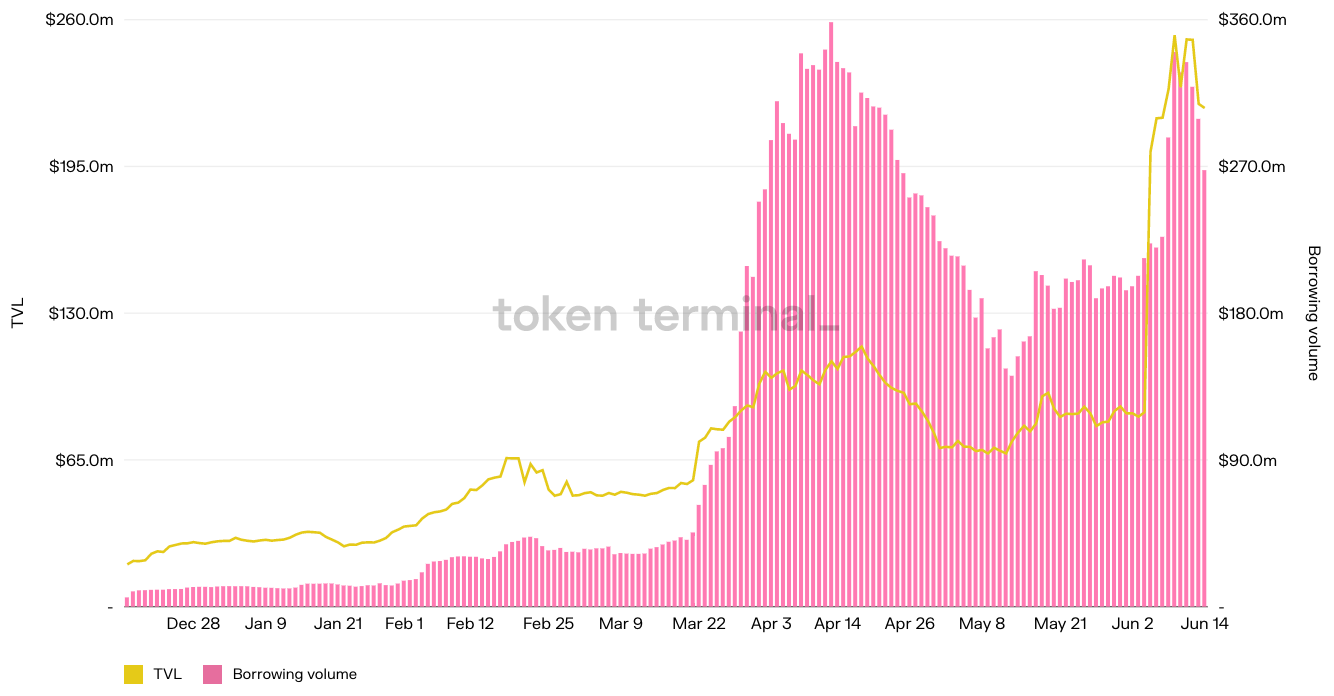

过去 180 天的每日锁定总价值和借贷量(Daily total value locked and borrowing volume in the past 180 days.)

过去 180 天的每日锁定总价值和借贷量(Daily total value locked and borrowing volume in the past 180 days.)

问:Euler 和其他借贷协议的主要区别是什么?(Q:What are the main differentiators between Euler and other lending protocols?)

We have a lot of differentiators, and I would advise anyone reading this to check out our whitepaper for a more detailed answer.

我们有很多与众不同之处,我建议任何阅读本文的人查看我们的白皮书 以获得更详细的答案。

When we first developed the Euler protocol, we were looking at how other lending protocols like Compound and Aave were only listing a small number of assets. They were in some way acting as gatekeepers to what people could lend or borrow on Ethereum. One of the key differentiators with Euler is allowing users to borrow almost any ERC20 token — so allowing the permissionless listing of assets. We are able to do this because we build on top of Uniswap v3 as a core oracle protocol. This enables users to activate their own markets and manage their lending and borrowing facilities.

当我们第一次开发 Euler 协议时,我们研究 Compound 和 Aave 等其他借贷协议为何只支持少量资产。他们(Compound 和 Aave)在某种程度上充当了人们在以太坊上借贷的看门人。 Euler 的主要区别之一是允许用户借入几乎任何 ERC20 代币——因此可以让资产无许可上市。我们之所以能够做到这一点,是因为我们构建在 Uniswap v3 之上的核心预言机协议。这使得用户能够激活他们自己的市场并管理他们的借贷设施。

However, the fact that we support the long tail of assets is not even our biggest feature. The one I’m most proud of developing is the way that we manage risks and improve capital efficiency relative to other lending protocols. The liquidation engine on Euler works in a way that borrowers who get liquidated end up paying a lot less in bonuses to the liquidators than they would elsewhere. This is important because large borrowers on Compound and Aave, who are taking out millions of dollars worth of loans, don't want to be paying a five or ten percent bonus from their collateral to liquidators if they were to be liquidated. To prevent this, they'll typically overcollateralize a lot more which ultimately lowers capital efficiency across those protocols and the wider DeFi ecosystem that depends on them. Euler reduces the bonus that's paid by these users, which massively increases capital efficiency on the protocol.

然而,支持长尾资产这一事实甚至不是我们最大的特点。我最引以为豪的发展是我们管理风险和相对于其他借贷协议提高资本效率的方式。 Euler 上清算引擎的工作方式是,被清算的借款人最终支付给清算人的奖金要比其他地方少得多。这一点很重要,因为 Compound 和 Aave 的大型借款人正在获得价值数百万美元的贷款,如果他们被清算,他们并不希望从其抵押品中向清算人支付 5% 或 10% 的奖金。为了防止这种情况,他们通常会进行更多的超额抵押,这最终会降低这些协议本身和更广泛的,依赖这些协议的 DeFi 生态系统的资本效率。 Euler 减少了这些用户支付的奖金,从而大大提高了协议的资本效率。

Finally, it's worth highlighting that we were one of the first protocols to innovate on the way interest rates are set in lending protocols. We have a reactive interest rate mechanism which is now talked about a lot in DeFi. We actually developed this a couple of years back as a way to set interest rates in a decentralized way, using something called control theory.

最后,值得强调的是,我们是最早在借贷协议中对设置利率的方式进行创新的协议之一。我们有一个回应性利率机制,现在已经在 DeFi 中被讨论了很多。实际上,我们在几年前参照控制论,开发了这种去中心化设定利率的方法。

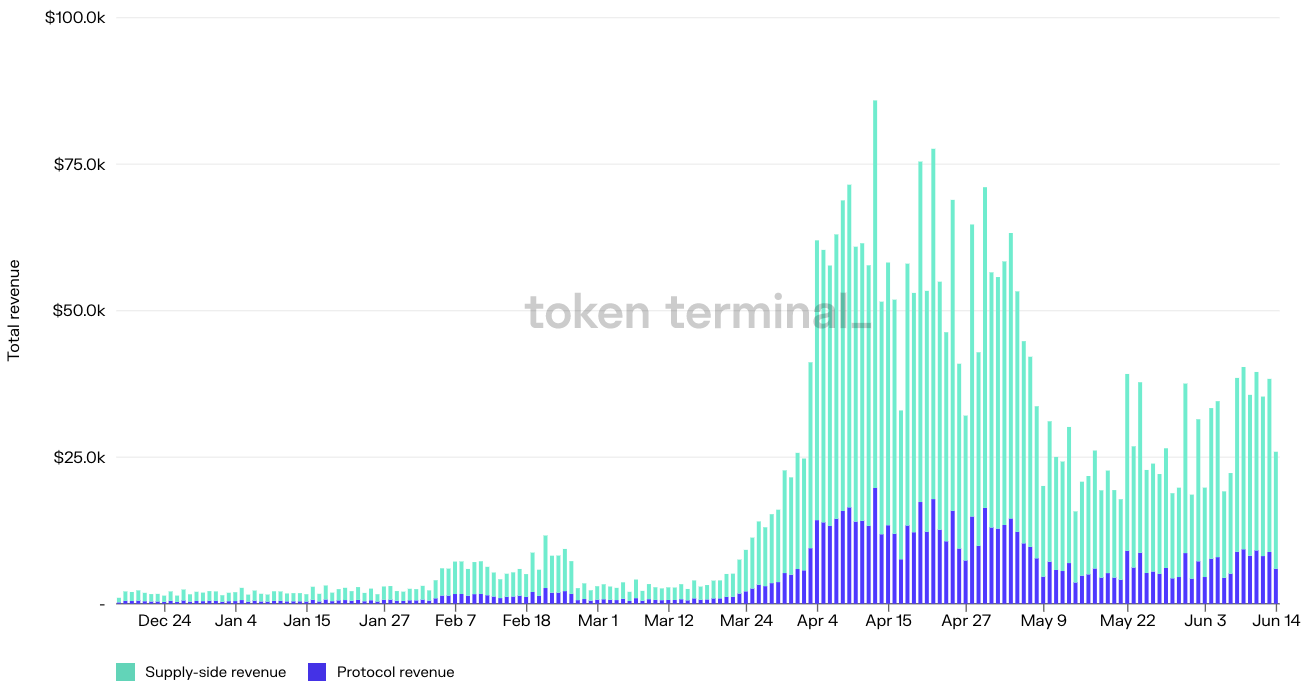

问:你能详述协议收入和协议管理储备的方法吗?(Q: Can you break down your protocol revenue and your approach to managing the protocol's reserves?)

How overcollateralized lending protocols typically work is that they take a portion of the interest paid by borrowers, and rather than hand that back to lenders they'll keep it within the protocol. The primary purpose of these so-called reserves is to backstop the protocol’s lenders.

超额抵押贷款协议的典型运作方式是,它们会收取借款人支付的部分利息,不会将它交还给出借方,而是将其保留在协议中。这些所谓的储备金的主要目的是支持协议的出借方。

From time to time some people will end up in a position where they can't repay their debts, which leads to something called bad debt. If bad debt spreads too much, lenders tend to get nervous that they might be left holding a bag of bad debt when they want to withdraw their assets. This nervousness leads to withdrawals, which ultimately leads to a spiral where lenders are front-running one another to withdraw, and you end up with a bank run in your hands. So the primary purpose of reserves is to be there to grow faster than bad debt accumulates on a protocol. On Euler, we think it's really important to generate reserves at the start when the protocol is in its infancy. This way you can accommodate more lenders.

有时,有些人最终会处于无法偿还债务的境地,这导致了所谓的坏账。如果坏账太大,出借方往往会担心,当他们撤回资产时,会不会持有一袋坏账。这种紧张会导致他们提款走人,最终导致出借方抢先退出和挤兑。因此,准备金的主要目的是使其增长速度快于协议上的坏账累积。在 Euler 上,我们认为在协议处于起步阶段时,在开始时就产生储备非常重要。这样您就可以容纳更多的出借方。

Say you're a lender wanting to deposit 100 million into Euler today and you see there's no reserves. This might make you nervous that you’d end up holding some bad debt in six months time. The more you can accumulate reserves, the more a lending protocol can accommodate lending, so you get these kind of cycling effects.

假设您是一个贷方,今天想向 Euler 存入 1 亿美元,但您发现没有准备金。这可能会让您感到紧张,因为您最终会在六个月内持有一些坏账。所以积累的储备越多,借贷协议就能容纳更多贷款,最终你会得到这种(正向)循环效应。

On Euler we do a few things differently to Compound and Aave with respect to how reserves grow and work. Reserves on Euler are perpetually reinvested back into the protocol so they earn compound interest and grow exponentially over time. Whilst the protocol is in its growing phases, we set a higher reserve factor on Euler which means that roughly a quarter of the interest paid actually goes back to the protocol and not back to the lenders. Obviously this comes with trade-offs. On one hand, the more you give back to lenders, the more they come to the protocol. While on the other hand you have this problem with lenders being nervous about bank runs and things. There's definitely a sweet spot that protocols try to hit.

在 Euler 上,我们在储备如何增长和运作方面做了一些与 Compound 和 Aave 不同的事情。 Euler 上的储备金会永久再投资回协议中,因此它们可以赚取复利并随着时间的推移呈指数增长。虽然协议仍处于发展阶段,但我们在 Euler 上设置了更高的准备金因子,这意味着大约四分之一的支付利息实际上会回到协议而不是回到出借方。显然,这需要权衡取舍。一方面,你回馈给出借方的越多,就会有更多的出借方到来。而另一方面,出借方则会对挤兑和其他事情感到紧张。协议肯定努力试图达到一个平衡点。

过去180天每日供应/出借方和协议收入 (Daily supply-side revenue and protocol revenue in the past 180 days.)

There's also another mechanism on Euler that tops up reserves through liquidations. Because of the aforementioned method we use to set the liquidation bonus, which works through a dutch auction mechanism, we allow liquidators to repay more of a loan than they actually need to. If a liquidator needed to pay 100 USD worth of USDC, they'll actually end up paying 102 USD worth of USDC on the loaned asset. These two extra dollars go to the protocol’s reserves. This means that when the market's turbulent and liquidations are flying around, the most volatile assets on the market that are triggering those liquidations actually see their reserves growing faster than the reserves of more stable assets. Thus lenders can be more confident about lending in the future. If you're lending something that's volatile, you should be more nervous about being left holding some bad debt at some point.

Euler 还有另一种机制,通过清算来补充准备金。由于我们使用上述方法设置清算奖金,该方法通过荷兰式拍卖运作,我们允许清算人偿还比实际需要更多的贷款。如果清算人需要支付价值 100 美元的 USDC,他们实际上最终会为借出的资产支付价值 102 美元的 USDC。这两个额外的美元将用于协议的储备金。这意味着,当市场动荡和清算四处蔓延时,市场上最波动的,触发这些清算的资产实际上会呈现其储备增长速度快于那些更稳定资产储备的增速。因此,出借方可以对未来的出借更有信心。如果你出借的东西不稳定,你应该更担心在某个时候持有一些坏账。

These are the two mechanisms by which our protocol reserves grow, hopefully exponentially, so that we can accommodate more lending in the future.

这是我们的协议储备增长的两种机制,有望成倍增长,以便我们在未来能够容纳更多的贷款。

问:在经历推出后头几个月的温和增长后,协议在 2022 年 3 月左右开始加速。您能解释一下这背后的驱动因素吗?(Q: After moderate growth during the first few months after launch, you picked up some speed around March 2022. Can you explain the drivers behind this?)

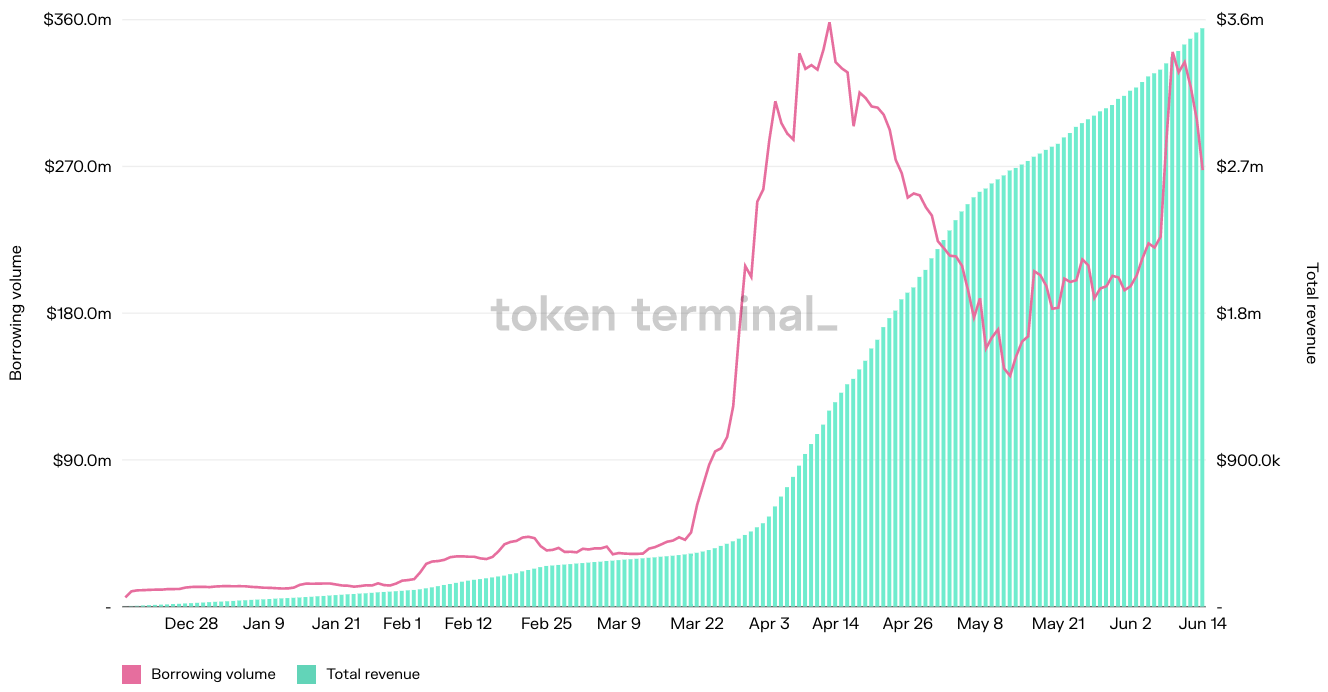

过去180天的每日借款量和累计总收入(Daily borrowing volume and cumulative total revenue in the past 180 days.)

When we launched back in December, we wanted to do so in a really risk-averse mode. I know that it's popular to launch a protocol to great fanfare and have people apeing in, but we didn't want that. There's lots of risks involved at the early stages and we didn't want to expose anybody using Euler to this. We launched with only three collateral assets and required everyone to overcollateralize by 4x on launch. Clearly this is not the kind of capital efficiency that you'd expect and hope to see from a DeFi protocol, but that was there to keep users safe. As we approached the new year, we started to demonstrate how governance proposals might work in the future to relax some of the constraints set on the protocol to improve capital efficiency and allow more borrowing. We started to illustrate how a proposal looks like to promote an asset to a collateral tier (we'll talk about these different tiers later), and added new collateral assets including wBTC, UNI, and LINK. There will presumably be more assets added as collateral types in the future.

当我们在(2021年)12月推出时,我们真诚希望实践一种真正规避风险的模式。我知道大张旗鼓推出一个协议并让人们“梭哈”是很受欢迎的,但我们不希望这样。早期阶段涉及很多风险,我们不想让任何使用Euler的人接触到这一点。我们仅使用三种抵押资产启动,并要求每个人在启动时超额抵押4倍。显然,这不是你期望并希望从 DeFi 协议中看到的那种资本效率,但那是为了保证用户的安全。随着新年的临近,我们开始展示治理提案在未来如何发挥作用:放松对协议设置的一些限制,进而提高资本效率并允许更多借款。我们开始说明提案如何将资产提升到抵押层(稍后将讨论资产的不同层级),并添加了新的抵押资产,包括 wBTC、UNI 和 LINK。未来可能会有更多资产作为抵押品类型添加。

We also started to relax some of the aggressive constraints we placed on capital efficiency, allowing people to borrow against their assets with a lot lower collateral ratios. This has definitely been driving our growth.

我们还开始放宽我们对资本效率施加的一些激进限制,允许人们以更低的抵押比率借入资产。这无疑推动了我们的增长。

Another aspect is that we will soon be launching a governance token, EUL, that will help manage the protocol and its governance. We’ve already started allocating EUL to users of the protocol through a distribution scheme in March, once we'd grown confident enough that the protocol was working as intended. Currently, you'll receive a distribution of EUL if you're borrowing on some of the key markets on the protocol. While the main purpose of the token is to distribute it back to ordinary users, these things tend to have a stimulating effect on some markets, which we probably see on the charts as well.

另一方面,我们将很快推出将有助于管理协议及其治理的治理代币EUL。当我们对协议按预期工作有足够的信心时,我们就已经在 3 月份开始通过分发方案将 EUL 分配给协议的用户。目前,如果您在协议的一些关键市场上借款,您将收到 EUL 的分配。虽然代币的主要目的是将其分发给普通用户,但这些东西往往会对某些市场产生刺激作用,我们也可能在图表上看到这一点。

问:EUL 代币当前状态以及向去中心化治理的过渡?(Q: What is the current status of the EUL token launch and your transition to decentralized governance?)

We were hoping to have it out about now, but of course it takes a little time to set these things up in the background. One thing that's been underway is the establishment of an Euler foundation. Its purpose will be to aid the DAO in future activities. If the DAO wants to e.g. distribute a grant to somebody to work on the protocol, the foundation will be there as a public face to represent the DAO in these contractual agreements. We're seeing that the foundation model is quite popular within DeFi, and we felt that it's a good model to take on board. We're hopeful that we'll be able to unlock the token and start decentralizing things in the coming months. It will be a process of progressive decentralization, and unfortunately we will be relying on the old multi-sig to control things for a little while longer.

我们希望现在就发布它,但是在后台设置某些东西当然需要一点时间。正在进行的一件事是建立Euler基金会。其目的是在未来的活动中帮助 DAO。如果 DAO 想要例如将赠款分配给某人从事该协议的工作,基金会将作为公众形象在这些合同协议中代表 DAO。我们看到基金会模式在 DeFi 中非常流行,我们认为这是一个很好的模型。我们希望我们能够在未来几个月内解锁代币并开始去中心化。这将是一个渐进式去中心化的过程,不幸的是,我们将依赖旧的多重签名来控制一段时间。

In the long run, I've been impressed with the way Compound progressed their decentralization and we'll most likely follow a similar model to that. I estimate the transition to full decentralization to happen sometime this year.

从长远来看,我对 Compound 推进去中心化的方式印象深刻,我们很可能会遵循类似的模式。我估计今年某个时候会过渡到完全去中心化。

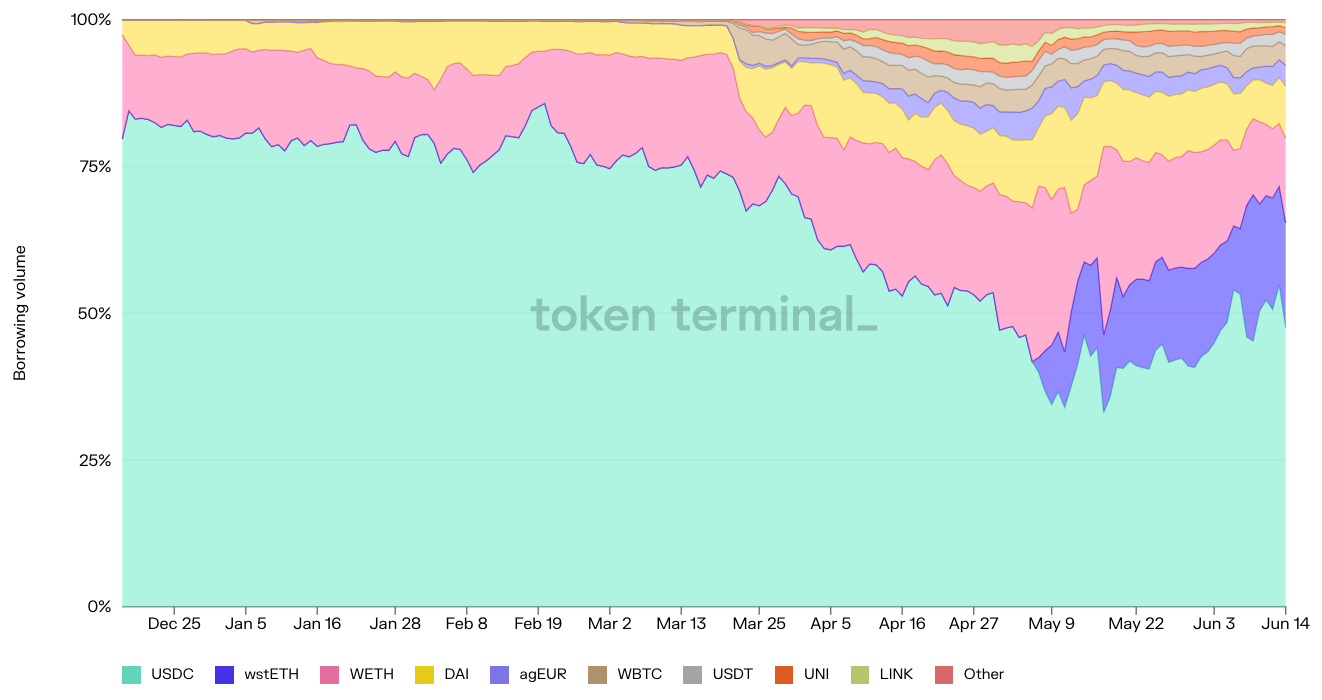

Q: 问:Euler借贷规模构成类似于我们在 Compound 和 Aave 等其他借贷协议上看到的,其中稳定币和 wETH 占了大部分。您对此处的相似性有何看法?您是否看到了借贷加密资产长尾的需求?(The composition of your borrowing volume is similar to what we'd see on other lending protocols like Compound and Aave, where stablecoins and wETH make up the bulk of it. What are your thoughts on the similarity here and are you seeing demand for lending and borrowing the long tail of crypto assets?)

过去180天内Euler每日借款规模构成(Daily borrowing volume composition on Euler in the past 180 days)

In general we'll always see a heavy bias towards the top five assets by market cap. These assets make up something like 60% of the total volume that you're likely to see anyway so there will always be an exponential distribution there in terms of volume on a lending protocol.

一般来说,我们总是会看到市值前五名资产的严重偏见。这些资产不论在哪都占总交易量的 60%,因此在借贷协议上的交易量总是呈指数分布。

In terms of demand for lending and borrowing the long tail of cryptoassets, I’m frankly not sure that there's massive demand yet. There are a few reasons for this: Firstly, a protocol hasn't existed that enables this in a capital efficient way before, so the market is in quite an immature state. Secondly, a lot of the advanced users who tend to borrow assets are using these assets for leverage. Leveraging longer tail assets is much harder and it requires less capital efficiency. A lot of these traders aren't doing this yet.

就借贷长尾加密资产的需求而言,坦率地说,我不确定是否存在大量需求。造成这种情况的原因有几个:首先,以前不存在以资本有效方式实现这一点的协议,因此市场处于相当不成熟的状态。其次,许多倾向于借入资产的高级用户正在使用这些资产进行杠杆。利用长尾资产要困难得多,而且对资本效率的要求也较低。很多交易者还没有这样做。

On Euler you can natively long or short assets, which I know plenty of people still don't realize. We even have a quick action menu for this functionality that people can use. In the long run this might become more popular as users start to experiment with it. However, I don't think you'll ever see the same demand for lending and borrowing the long tail of assets, as they’re very volatile by nature and sometimes more illiquid which lowers capital efficiency. The use cases are also more niche, resulting in less demand. Whilst Euler offers the functionality, it's not our reason for being. It's nice to support that for more philosophical reasons; being a permissionless protocol and wanting to support a decentralized ecosystem. If you're a lender, e.g. a retail trader, and you hold a basket of five to ten assets, you have the option to hunt around DeFi and try to find homes for each of those assets to try to and earn yield. In the long run, you’ll be able to come to Euler and do all that in one place.

在 Euler 上,您可以原生地做多或做空资产,我知道很多人仍然没有意识到这一点。我们甚至为人们可以使用的此功能提供了一个快速操作菜单。从长远来看,随着用户开始尝试它,这可能会变得更受欢迎。但是,我认为您不会看到对长尾资产也有相同的借贷需求,因为它们本质上非常不稳定,有时流动性更差,进而降低了资本效率。它们的用例也更小众,所以需求也减少。虽然 Euler 提供了功能,但这不是我们存在的理由。出于更哲学的原因,我们很高兴支持这一点,毕竟我们是一个希望支持去中心化生态系统的无许可协议。如果您是出借方,例如作为一名零售交易员,你持有一篮子 5 到 10 种资产,你可以选择在 DeFi 周围搜寻并尝试为每一种资产寻找“归宿”,来尝试赚取收益。从长远来看,您将会来到 Euler 并在此一站式完成所有这些工作。

Like a lot of companies in the world of traditional finance will try to encourage users by offering home insurance, car insurance, banking, etc., I can see Euler becoming a one-stop-shop. There are auxiliary benefits to having long-tail assets without there being enormous demand for e.g. shorting the MKR token.

就像传统金融领域许多公司尝试提供家庭保险、汽车保险、银行等来鼓励用户一样,我可以预见 Euler 正在成为一站式商店。在没有巨大需求的情况下,拥有长尾资产有一些辅助好处,例如做空 MKR 代币。

问:您如何管理风险?(Q: How are you managing risk?)

There’s lots of different mechanisms in place and tweaks to the classic model that enable risk to be managed on Euler. One of the simplest things that we implemented right from the start was the concept of a borrow factor. If you're lending and borrowing on Compound or Aave and you deposit e.g. USDC, you have two options: you can borrow some DAI, or borrow something more volatile like LINK. Your borrowing power is determined by what you've deposited as collateral, not by what you're borrowing. This doesn't really make much sense because the DAI to USDC loan is much less risky than the LINK to USDC loan. LINK can obviously go up or down in price quickly, exposing lenders to risk. The collateralization ratios for those two different types of assets should depend not just on what you're using as collateral, but also what you're borrowing. By introducing borrow factors that account for that volatility on the borrowing side as well, you can raise capital efficiency across the entire protocol.

有许多不同的机制和对经典模型的调整来帮助在Euler启动风险管理。我们最先就实施的,最简单的事情之一就是“借入因子”的概念。如果您在 Compound 或 Aave 上借贷并且您存入USDC,你有两个选择:你可以借一些 DAI,或者借一些更不稳定的东西,比如 LINK。你的借贷能力取决于你存入的抵押品,而不是你借入的东西。但这并没有多大意义,因为 DAI 到 USDC 的贷款比 LINK 到 USDC 的贷款风险要小得多。 LINK 的价格显然会迅速上涨或下跌,从而使出借方面临风险。这两种不同类型资产的抵押率不仅取决于您用作抵押品的方式,还取决于您借入的方式。通过引入考虑借款方波动性的借入因子,您可以提高整个协议的资本效率。

On Compound for instance, the collateral factors of every asset are somewhat constrained by the protocol’s most volatile asset. This being the lowest common denominator which helps determine what the highest collateral factor can be even for something like USDC. Introducing borrow factors is something I think every protocol needs to do if they're supporting a variety of different types of assets from collateral to illiquid, which is what we’ve done at Euler.

例如,在 Compound 上,每种资产的抵押因子都受到协议中波动最大的资产的限制。这是最低的公分母,它有助于确定最高的抵押因子,甚至是像 USDC 这样的稳定币。如果每个协议都支持从抵押品到流动性欠佳的各种不同类型的资产,我认为引入借入因子是每个协议都需要做的事情,也正是我们在 Euler 所做的事情。

We also have asset tiers which determine what you can do with different assets. Collateral tier assets are available for ordinary lending and borrowing, cross-borrowing, and they can be used as collateral. Cross tier assets are available for ordinary lending and borrowing, and cannot be used as collateral to borrow other assets, but they can be borrowed alongside other assets. And finally we have the least risky tier which is the isolated tier. Isolated tier assets are available for ordinary lending and borrowing, but they cannot be used as collateral to borrow other assets, and they can only be borrowed in isolation. If you take out a borrow of LINK (isolated tier), you can use any type of collateral you want but you can only borrow LINK from that one account. This helps protect lenders from the risks of liquidations firing off on people's accounts and leaving some markets with bad debt.

我们还有资产层级/分层,这些层级决定了您可以使用不同的资产做什么。抵押层资产可用于普通借贷、交叉借贷,并可用作抵押物。跨层/交叉层资产可用于普通借贷,不能作为抵押物借入其他资产,但可以与其他资产一起借入。最后,我们有风险最小的层,即隔离层。隔离层级资产可用于普通借贷,但不能作为抵押品借入其他资产,只能单独借入。如果您借用 LINK(隔离层),您可以使用任何类型的抵押品,但您只能从一个账户借用 LINK。这有助于保护出借方免受清算对人们账户的影响,比如让一些市场出现坏账。

Being able to only borrow one asset from one account would be a bit painful, and would result in users having to create new accounts and move collateral between them. To solve this, we invented a system to have sub accounts generated from a single Ethereum address, so users can deposit collateral to a single address and isolated margin trade using the sub accounts that are native to that address on chain. Much like you can do isolated margin trading on e.g. Binance, you can now do that in DeFi through Euler in an overcollateralized way. These accounts are useful for risk management. If you want to take out multiple borrows — even if they're not forced to be separate from one another — you might want to do so because it's prudent to separate the collateral for different types of loans.

只能从一个账户借入一项资产会有点痛苦,并且会强制让用户创建新账户并在它们之间转移抵押品。为了解决这个问题,我们发明了一个系统,从单个以太坊地址生成子账户,因此用户可以将抵押品存入单个地址,并使用该链上地址的本地子账户进行隔离性保证金交易。就像您可以进行隔离的保证金交易一样,例如Binance,你现在可以通过 Euler 在 DeFi 中以超额抵押的方式做到这一点。这些帐户对于风险管理很有用。如果您想进行多笔借款——即使它们没有被迫彼此分开——其实您可能想要这样做,因为将不同类型贷款的抵押品分开是谨慎的做法。

问:Euler的下一步是什么?(Q: What’s next for Euler?)

Some of the things we’re working on at the moment include thinking about support for different oracle types, and support for Layer 2s and other networks. We’re also exploring integrations with other protocols. One of the things that I'm most interested in at the moment is options and the extent to which Euler could support options trading in DeFi. By combining Uniswap with something like Euler, you can generate a powerful options capability on-chain, which would be very exciting.

我们目前正在做的一些事情包括:考虑支持不同的预言机类型,以及对layer2和其它网络的支持。我们还在探索与其他协议的集成。我目前最感兴趣的一件事是期权,以及 Euler 可以在多大程度上支持 DeFi 中的期权交易。通过将 Uniswap 与 Euler 之类的东西结合起来,你可以在链上生成强大的期权能力,这是非常令人兴奋的。

As we start to decentralize, we hope that other people will start contributing to this ecosystem as well.

随着我们开始去中心化,我们希望其他人也能开始为这个生态系统做出贡献。

The interview concluded.

采访结束。